iphone4-apple.ru

Community

Spacaps

The meter-high Spahats Waterfall can be reached via a simple hiking trail. For centuries it has milled through the reddish-brown. Buy Merchandise from the official Red Bull Online Shop & become part of the team: Max Verstappen Spa Caps. This route begins in the parking lot for Spahat Falls. It goes through an old-growth forest alongside the river. "Spahats" is a First Nations term for bear. Check out SPACAPS Stock Reports on The Economic Times. Complete detailed Stock Analysis for SPACAPS, SPACAPS Earnings Indicators, SPACAPS Earnings per share. Spa Capital Services Ltd Board of Directors & Management, Spacaps Registered Office, Spacaps Registrars, Company Information. Check out SPACAPS Stock Reports on The Economic Times. Complete detailed Stock Analysis for SPACAPS, SPACAPS Earnings Indicators, SPACAPS Earnings per share. Engage in chats with fellow traders via SPACAPS Minds. Explore the BSE:SPACAPS forum and gain insights from trading discussions with millions of investors. There is no direct connection from Vancouver to Spahats Creek Falls. However, you can take the bus to Kamploops, BC, take the taxi to Kamloops North, take the. Highlights in this site. Beautiful views of Spahats Falls and the Clearwater River valley make this a very popular day-use stop for tour buses. Old growth cedar. The meter-high Spahats Waterfall can be reached via a simple hiking trail. For centuries it has milled through the reddish-brown. Buy Merchandise from the official Red Bull Online Shop & become part of the team: Max Verstappen Spa Caps. This route begins in the parking lot for Spahat Falls. It goes through an old-growth forest alongside the river. "Spahats" is a First Nations term for bear. Check out SPACAPS Stock Reports on The Economic Times. Complete detailed Stock Analysis for SPACAPS, SPACAPS Earnings Indicators, SPACAPS Earnings per share. Spa Capital Services Ltd Board of Directors & Management, Spacaps Registered Office, Spacaps Registrars, Company Information. Check out SPACAPS Stock Reports on The Economic Times. Complete detailed Stock Analysis for SPACAPS, SPACAPS Earnings Indicators, SPACAPS Earnings per share. Engage in chats with fellow traders via SPACAPS Minds. Explore the BSE:SPACAPS forum and gain insights from trading discussions with millions of investors. There is no direct connection from Vancouver to Spahats Creek Falls. However, you can take the bus to Kamploops, BC, take the taxi to Kamloops North, take the. Highlights in this site. Beautiful views of Spahats Falls and the Clearwater River valley make this a very popular day-use stop for tour buses. Old growth cedar.

Nestled in the heart of Clearwater, British Columbia, lies Spahats Creek Resort - a breathtaking resort located just across the road from Spahats Falls on. Where to stay near Spahat Falls? · Hotel Civilia Lakeside by Civilia Golf Retreat · Best Western Plus Gateway to the Falls · Clearwater Valley Resort · Wells. Spahats Falls Trail is a m green singletrack trail located near Clearwater British Columbia. This hike primary trail can be used both directions. SPA OZONE · DEL Ozone Spa for up to 1, Gal · DEL Ozone MCDU for Spas SpaCap. There are no products listed under this brand. Home · Shop by Category. Experience the ultimate bathing experience in your hot tub with our groundbreaking SPA CAPS® disinfection system! Nestled in the heart of Clearwater, British Columbia, lies Spahats Creek Resort - a breathtaking resort located just across the road from Spahats Falls on. Campground, Resort, located across from Spahats Falls, at the base of the Trophy Mountain access Road. Spa Caps 85" x 85" Hot Tub Doctors % Spa Caps 85" x 85". View "spahat falls" in videos (3) Spahats Falls on Spahats Creek in Wells Gray Provincial Park at Clearwater British Columbia, Canada. TUFF SPA CAPS FOR COVER MODELS: ALL MODELS built 4 per order, GORILLA GLUE NOT INCLUDED. ADHERE WITH GORILLA GLUE. The Spahats Falls Trail is a fun adventure north of Clearwater, BC, that will take you through a peaceful forest setting to a lookout over a majestic. Greer to Spahats. Ride Segment Clearwater, British Columbia, Canada. Distance km. Elevation Gain m. Avg Grade %. Lowest Elev m. Highest Elev m. The first waterfall (Spahats Falls) is only a 10 minute drive up the Clearwater Valley Road, which means that even if you only have half an hour to spare, you. Spahats Falls (Spahats Creek Falls) is a m waterfall leaping out of a narrow hanging gorge into a wider gorge in Wells-Gray Provincial Park near. Spacaps Share Price. Chart; Financials; Technicals; Volume; Corp Action; MF Shareholding; Similar Stocks; FAQs. SPACAPS. SPA. This route begins in the parking lot for Spahat Falls. It goes through an old-growth forest alongside the river. "Spahats" is a First Nations term for bear. Wells Gray Provincial Park--Spahats Creek Falls. Thompson-Nicola · British Columbia · Canada · Directions Map. Region Stats. 78 Species 28 Checklists Browse 'Spahats Falls ' Landscape Photo Print. Harmony out of water and time captured in Wells Gray Provincial Park, BC. Available as print-only. SPA Capital Services Limited Stock technical analysis with dynamic chart and Delayed Quote | Bombay S.E.: SPACAPS | Bombay S.E.

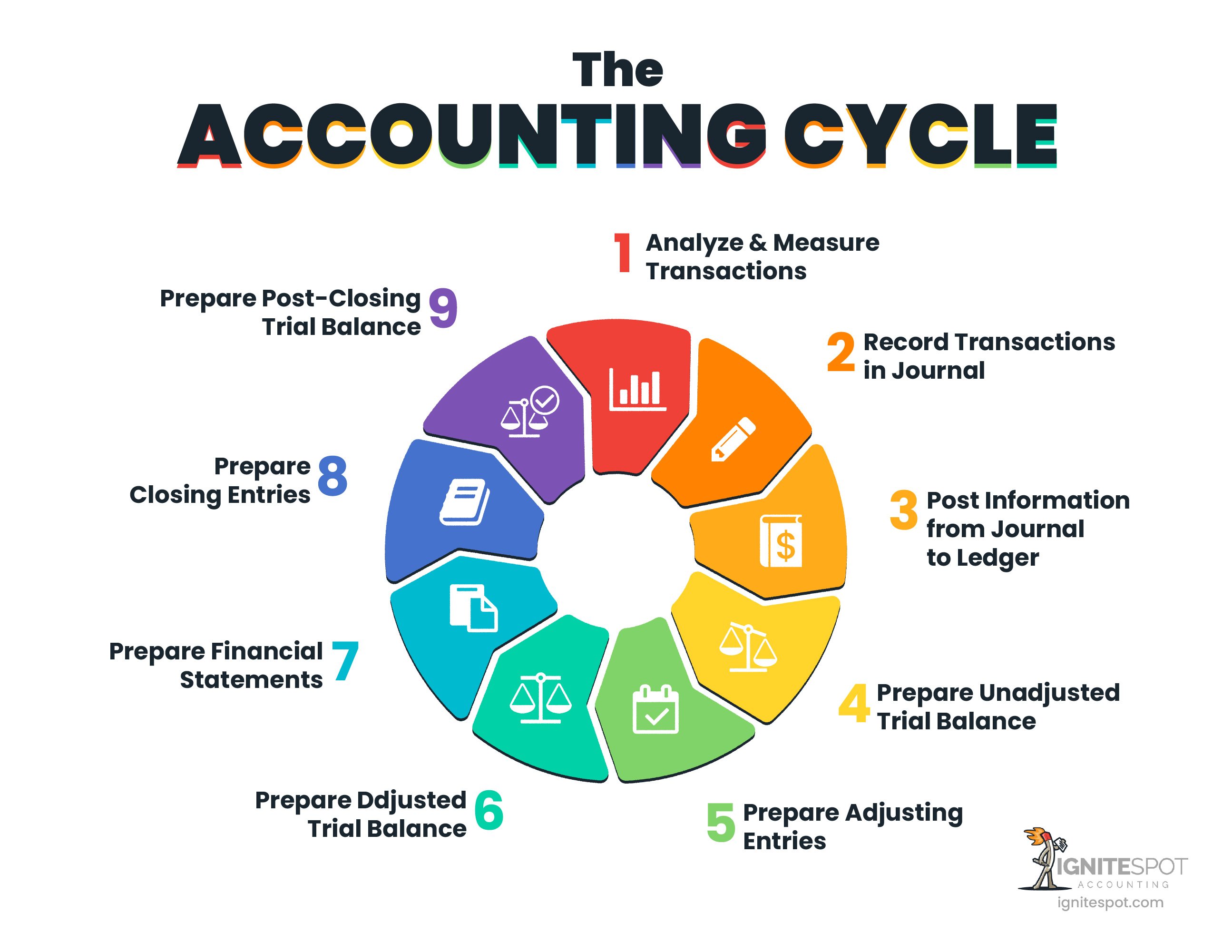

What Types Of Accounting Are There

Accounting can be classified into two categories – financial accounting and managerial accounting. Importance of Accounting. 1. Keeps a record of business. Accountants generally have a bachelor's or master's degree, but there also are associate and doctoral degrees in accounting. Though there are 12 branches of accounting in total, there are 3 main types of accounting. These types are tax accounting, financial accounting, and management. Financial Analyst · Tax Consultant. What is an Accountant and What Do They Do? Accountants work with individuals, small businesses, large corporations, non-. Though there are 12 branches of accounting in total, there are 3 main types of accounting. These types are tax accounting, financial accounting, and management. There are plenty of paths to take within the accounting profession. Here are just a few. Financial Accounting Financial accountants deal with cash in-flow and. The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. A public accountant is a professional who performs tasks such as tax, auditing, consulting, and accounting for a public accounting firm. Accounting information systems are designed to support accounting functions and related activities. Accounting has existed in various forms and levels of. Accounting can be classified into two categories – financial accounting and managerial accounting. Importance of Accounting. 1. Keeps a record of business. Accountants generally have a bachelor's or master's degree, but there also are associate and doctoral degrees in accounting. Though there are 12 branches of accounting in total, there are 3 main types of accounting. These types are tax accounting, financial accounting, and management. Financial Analyst · Tax Consultant. What is an Accountant and What Do They Do? Accountants work with individuals, small businesses, large corporations, non-. Though there are 12 branches of accounting in total, there are 3 main types of accounting. These types are tax accounting, financial accounting, and management. There are plenty of paths to take within the accounting profession. Here are just a few. Financial Accounting Financial accountants deal with cash in-flow and. The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. A public accountant is a professional who performs tasks such as tax, auditing, consulting, and accounting for a public accounting firm. Accounting information systems are designed to support accounting functions and related activities. Accounting has existed in various forms and levels of.

1. Different accounting classes and courses available to students · Principles of Accounting I (Introduction to Accounting I) · Principles of Accounting II . There are several types of accounting that have emerged due to economic and industrial developments. The main types are financial accounting. The different types of accounting · 1. Financial accounting · 2. Managerial accounting · 3. Cost accounting · 4. Tax accounting · 5. Auditing · 6. Forensic accounting. Types of accounting · 1. Financial accounting · 2. Managerial accounting · 3. Cost accounting · 4. Auditing · 5. Tax accounting · 6. Accounting information systems · 7. What are the eight branches of accounting? · Financial accounting · Cost accounting · Auditing accounting · Managerial accounting · Accounting information systems. What are the eight branches of accounting? · 1. Financial accounting · 2. Cost accounting · 3. Auditing accounting · 4. Managerial accounting · 5. Accounting. There are four main types of accounting which include; -Public accounting · Public accounting · Government accounting · Managing to account · Internal auditing. Tax Accounting; Forensic Accounting; Fiduciary Accounting. Financial Accounting. Financial accounting entails recording and categorizing business transactions. Account Types ; ACCOUNTS PAYABLE, Liability, Decrease, Increase ; ACCOUNTS RECEIVABLE, Asset, Increase, Decrease. There are several different types of accounting–from cost auditing to public accounting–but two of the most common are managerial (sometimes referred to as. What are the eight branches of accounting? · Financial accounting · Cost accounting · Auditing accounting · Managerial accounting · Accounting information systems. Managerial Accounting; Financial Accounting; Tax Accounting; Government Accounting; Non-Profit Accounting; Auditing. There are several other types of accounting. The financial transactions are mainly recorded in two methods of accounting. The Cash method and the Accrual method. There are various kinds of accounting. There Are 3 Types Of Accountants: Those Who Can Count, And Those Who Can't.: Funny Accountant Gag Gift, Coworker Accountant Journal, Funny Accounting. There are five main types of accounts used in business. These accounts include asset accounts, liabilities accounts, equity accounts, expenses accounts, and. 1. Full-Service Accounting Firms · 2. Tax Firms · 3. Audit Firms · 4. Risk Firms · 5. Outsourced Accounting Firms · 6. Bookkeeping Firms. Their responsibilities include auditing, financial reporting, and management accounting. Management accountants are also called cost, corporate, industrial. Accountancy is a vast field offering many opportunities to those eager to join it. In addition, there are many educational routes someone can take to get ahead. 1. Different accounting classes and courses available to students · Principles of Accounting I (Introduction to Accounting I) · Principles of Accounting II . their securities for other stock or securities of a different type. Receivable Turnover. A ratio for measuring the relative size of a company's accounts.

Selling A House After Less Than 1 Year

.png)

To qualify for the exclusion, the property must have been owned by you for two out of the prior five years and must have been used as your primary residence. Your profit when you sell a stock, house or other capital asset. If you owned the asset for more than a year, the gain is considered long-term, and special tax. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. As long as you come back to live in the same home for one more year, you will satisfy the two out of five rule. Assuming you've passed the "two out of five rule. You would owe short term capital gains tax if you sell in under a year. If you sell in under two, then you just pay regular capital gains tax. The deduction cannot result in taxable income being less than zero. Withdrawals or distributions for taxable years beginning after Dec. 31, used for. Better after 1 year then before. Less then one year you will pay short term capital gains if you have any gains. After 1 year you pay long term. • Owned and used the property as your principal residence for less than two years, If you moved after October 1 of the application year or plan to move. year ownership and residence requirements on your own, consider the following rule. sold less than 2 years before the date of the current home sale; and. You. To qualify for the exclusion, the property must have been owned by you for two out of the prior five years and must have been used as your primary residence. Your profit when you sell a stock, house or other capital asset. If you owned the asset for more than a year, the gain is considered long-term, and special tax. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. As long as you come back to live in the same home for one more year, you will satisfy the two out of five rule. Assuming you've passed the "two out of five rule. You would owe short term capital gains tax if you sell in under a year. If you sell in under two, then you just pay regular capital gains tax. The deduction cannot result in taxable income being less than zero. Withdrawals or distributions for taxable years beginning after Dec. 31, used for. Better after 1 year then before. Less then one year you will pay short term capital gains if you have any gains. After 1 year you pay long term. • Owned and used the property as your principal residence for less than two years, If you moved after October 1 of the application year or plan to move. year ownership and residence requirements on your own, consider the following rule. sold less than 2 years before the date of the current home sale; and. You.

And you must have lived in the house as your principal residence for two out of the last five years, ending on the date of sale. There are exceptions to these. In any event, selling a house or condo shortly after you bought it isn't ideal. less on day 87 than you could have on day 14 had you listed at market. Another strategy is to consider a exchange, which allows you to defer paying capital gains tax by reinvesting the proceeds from the sale of one property. So, when your property was your principal residence for two of the five years before the sale, and the payment or other consideration for your property is not. If you buy a home and a dramatic rise in value causes you to sell it a year later, you would be required to pay full capital gains tax—short-term or long-term. When you sell after less than a year of owning a home, your profit is a short-term capital gain and is taxed at ordinary income rates. Once you've owned the. The gain or loss on an asset held for more than one year is considered “long term.” If the taxpayer disposes of an asset after holding it for a year or less. But, if you make a profit, you can often exclude it. This is called “home sale exclusion”, or less commonly “sale of a personal residence exclusion”. Taxes for. The “2-out-ofyears rule” is part of the criteria that must be met in order to avoid or reduce capital gains tax when selling a home. It might not be what you want to do, but if you sell for less than you owe, you can move the home off the market much faster. You also have a better chance of. A: If you're selling a house within one year of purchase, you could be subject to capital gains taxes. Homeowners who sell their house after owning it for 1. However, if the residential property is also a taxpayer's principal residence, the sale is exempted from capital gain tax. This exemption is known as the. In principle, the owner of a residential property can sell it again as soon as he or she wants to. However, some banks, building societies and mortgage. Primary Residence: You must have owned and used the home as your primary residence for at least two of the five years leading up to the date of the sale. The. The entire gain must be reported on your tax return, even if part of it is excludable. You may also take advantage of this exclusion more than once, should you. FSBOs typically sell for less than the selling price of other homes; FSBO homes sold at a median of $, last year, significantly lower than the median of. The IRS allows single taxpayers that make an inherited property their primary residence for at least two years of the five years preceding the sale of the. year after the sale of the original property,. percent of the If the market value of the replacement property is less than the factored base year. Selling your second home? When you sell a vacation home, rental, fix-and-flip, or any second property that is not your primary residence, you will typically. fewer capital gain taxes if they choose to sell the house. Capital gains taxes are imposed on the profit resulting from the sale of the home. Since the home.

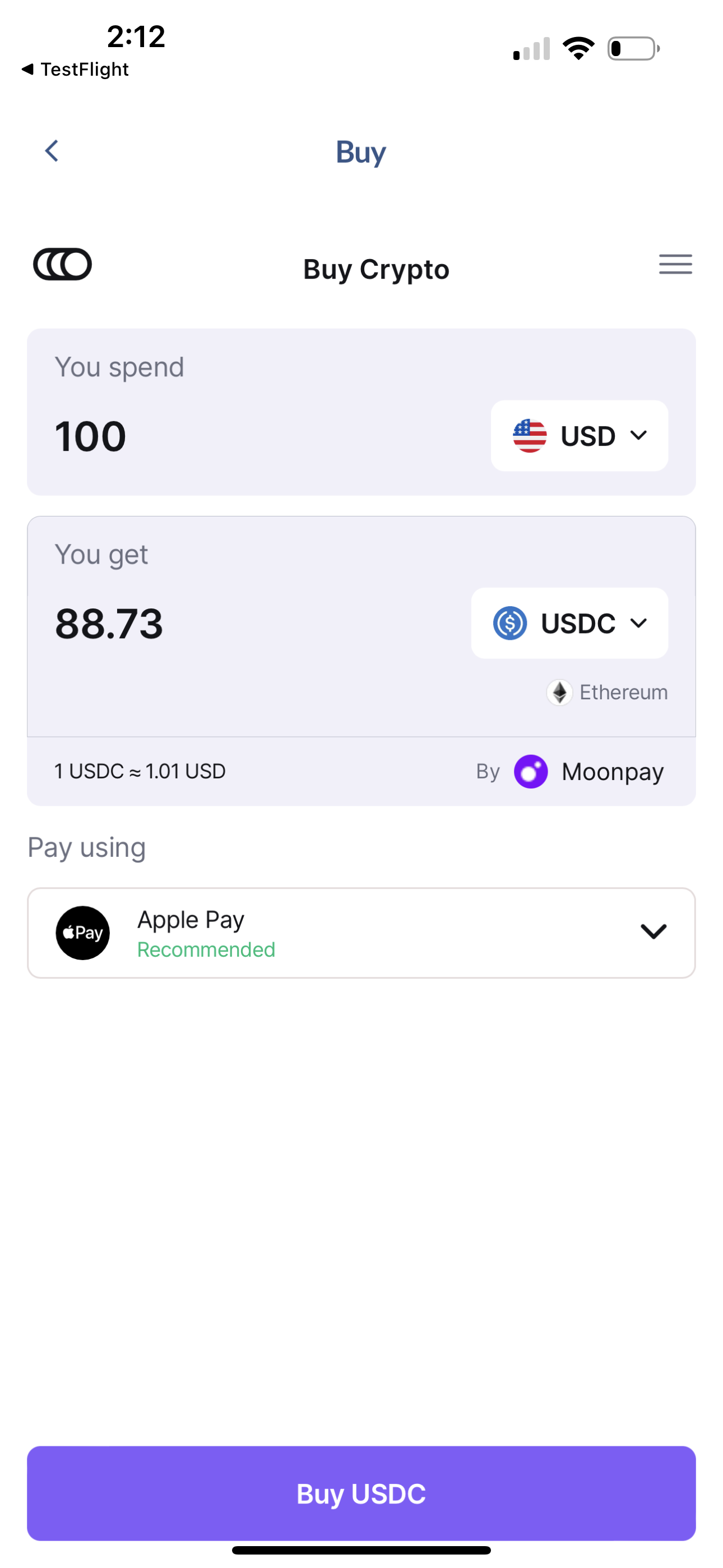

Buy Usd

Buy US dollars online or in-store with eurochange for great rates with no commission. Click & Collect in 60 seconds or free next day delivery on £ and. Buy your US Dollars through Travel FX with confidence, delivered safely and securely to your door with Royal Mail Special Special Delivery. You can order US Dollars (USD - $), at better exchange rates than banks and credit cards, with delivery in two business days to any address in Canada. From transferring funds to a foreign bank account, exchanging money for travel, to converting CAD to USD in your bank account. Drafts We Buy. Drafts We Sell. Manor FX is the best place to buy US dollars, offering an easy and secure online ordering process. It's a convenient way to get your travel money sorted before. Pick up US dollars within 2 hours of ordering. Order online for our best rates and get better rates the more you buy. Delivery is free on orders of £ or. Orient Exchange provides best rate for usd, Buy & Sell US Dollars online and get the best exchange rate from the RBI authorized Foreign Currency Exchange. US dollar(USD) - Get complete info about US dollar exchange rate. Buy, Sell or Transfer US dollar online at best exchange rates in India with Thomas Cook! Compare the best USD rates from some of the biggest travel money providers to have your holiday funds conveniently delivered to your home. Buy US dollars online or in-store with eurochange for great rates with no commission. Click & Collect in 60 seconds or free next day delivery on £ and. Buy your US Dollars through Travel FX with confidence, delivered safely and securely to your door with Royal Mail Special Special Delivery. You can order US Dollars (USD - $), at better exchange rates than banks and credit cards, with delivery in two business days to any address in Canada. From transferring funds to a foreign bank account, exchanging money for travel, to converting CAD to USD in your bank account. Drafts We Buy. Drafts We Sell. Manor FX is the best place to buy US dollars, offering an easy and secure online ordering process. It's a convenient way to get your travel money sorted before. Pick up US dollars within 2 hours of ordering. Order online for our best rates and get better rates the more you buy. Delivery is free on orders of £ or. Orient Exchange provides best rate for usd, Buy & Sell US Dollars online and get the best exchange rate from the RBI authorized Foreign Currency Exchange. US dollar(USD) - Get complete info about US dollar exchange rate. Buy, Sell or Transfer US dollar online at best exchange rates in India with Thomas Cook! Compare the best USD rates from some of the biggest travel money providers to have your holiday funds conveniently delivered to your home.

Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. USD (U.S. dollars). The following is an example of a forex quote: EUR/USD buy low. Factors that Influence Exchange Rates Between Currencies. In the. Over the past 30 days, the US dollar rate is up % from on 11 August to today. This means one pound will buy more US dollars today than it. It's usually expressed as the domestic price of the foreign currency. So if it costs a U.S. dollar holder $ to buy one euro, from a euroholder's perspective. Buy, Sell or Transfer US Dollar at the Best Rates in India. BookMyForex compares US Dollar rates across hundreds of banks and forex companies in your area. US Dollars to transact there. You can now buy or sell USD at the best US dollar exchange rate in your city online with BookMyForex which is India's first. Buy Foreign Currency · CURRENCY AT A CLICK Icon · WE'VE GOT YOU Icon · HOW MUCH SHOULD I BRING? · WHY CARRY CASH WHEN TRAVELING ABROAD? Buy and sell USDC at Bitstamp – the world's longest-standing crypto exchange. Open a free account. Over the past 30 days, the US dollar rate is up % from on 10 August to today. This means one pound will buy more US dollars today than it. Purchase goods from overseas · Sell international shares · FX Rates & tools. Check rates USD – US dollar. To. CAD – Canadian dollar. USD/CAD currency chart. BookMyForex compares US Dollar rates across hundreds of banks and forex companies in your area, helping you discover the best rate for your forex requirements. The US Dollar is currently the official currency of the United States of America - USA and various other countries besides being the de facto currency in many. Enjoy convenience and competitive rates when buying US Dollars with Philippine Pesos using our online facility. You can also buy US Dollars by phone. Give us a call on 03to order Dollars and pay over the phone for home delivery. Buy US Dollars (USD) online with Travelex. See today's NZD to USD exchange rate and lock in great rates with 0% commission. Pick up in-store. USD US Dollar · ZAR South African Rand. What is OANDA's Currency Converter What is the best time to exchange my money or to buy or sell currencies? Buying a Home. Starting a Business. Planning to Retire. New to Canada. Tools & Calculators. See All. Featured. Starting A Business · Managing my Money · Start. Buy and sell Bitcoin at Bitstamp – the world's longest-standing crypto exchange. Open a free account. Order US Dollars online through John Lewis Money at a great rate and pay no commission. Arrange delivery, click and collect or visit one of our 31 Bureaux. Buy USD online or from any of our stores in Australia, fee and commission-free! Get same-day delivery or collection when you order online. Your best AUD to.

What Can I Do As A Side Business

Creating a business plan is a great practice for any small business, even if it's a side hustle (for now). A business plan acts as your blueprint to make your. I thought my skill as a software engineer was enough to come up with a product people would pay for. Wrong. I missed some obvious steps: Does. 44 Side Hustle Ideas to Make Extra Money in Do you need some extra cash? Here are 44 side hustles for making money on the side. From freelancing to selling. For many people, side hustles are the first step to refining a small business idea or opportunity - you can get a taste for running your own business without. Step 1 – Pick Your Side Hustle · Logo designer · Banner image designer · Ebook cover designer · Facebook Header designer · Twitter Header designer · Cartoons. Getting off the ground · Do: Make sure you're ready. · Do: Choose the right business for you. · Do: Get on top of your financial life. · Do: Find new friends who. Depending on your competencies and interests, there are many side hustles you can choose from including freelance writing, working with animals. If you're tech-savvy, testing the latest apps and platforms can be an exciting side hustle for you. This online business idea lets you earn extra cash by. These won't make you rich, but can be an easy way to supplement your income and you can do them in your downtime (waiting in line, watching TV, etc.). If you. Creating a business plan is a great practice for any small business, even if it's a side hustle (for now). A business plan acts as your blueprint to make your. I thought my skill as a software engineer was enough to come up with a product people would pay for. Wrong. I missed some obvious steps: Does. 44 Side Hustle Ideas to Make Extra Money in Do you need some extra cash? Here are 44 side hustles for making money on the side. From freelancing to selling. For many people, side hustles are the first step to refining a small business idea or opportunity - you can get a taste for running your own business without. Step 1 – Pick Your Side Hustle · Logo designer · Banner image designer · Ebook cover designer · Facebook Header designer · Twitter Header designer · Cartoons. Getting off the ground · Do: Make sure you're ready. · Do: Choose the right business for you. · Do: Get on top of your financial life. · Do: Find new friends who. Depending on your competencies and interests, there are many side hustles you can choose from including freelance writing, working with animals. If you're tech-savvy, testing the latest apps and platforms can be an exciting side hustle for you. This online business idea lets you earn extra cash by. These won't make you rich, but can be an easy way to supplement your income and you can do them in your downtime (waiting in line, watching TV, etc.). If you.

4. Open a business bank account. Now we're getting to the fun part, because you'll need someplace to stash all that extra side hustle cash! Your next stop is. Graphic design is one of the best side business ideas that you can use to make extra money while also working full-time. You can do freelance work in your free. Freelance bookkeeping. Part-time bookkeeping is a good side business you can do from anywhere, with cloud accounting software like Freshbooks (check out our. A trusted resource and service provider for business incorporation, LLC filings, and corporate compliance services in all 50 states. Although many side hustles can seem less formal than starting a business, it's important to be mindful of any financial, legal, and tax implications of earning. Prioritize not only the actions required to start your side hustle business but also activities from your everyday life and to-do list. Your side hustle will. If so, start a bakery business from home. Popular items to sell include customized cakes, cookies, cupcakes, and party favors. You can also choose to sell your. Business ideas to generate side income · 1. Rideshare driver. Living in an area with lots of bars, restaurants and nightlife might earn you a few extra bucks if. 1. House Cleaning. Start by cleaning houses in your area and when your clientele grows, you can hire agents to cover more clients' houses in a day. If you want to set up a business as a secondary trade, there are some important points you need to consider to make sure everything runs smoothly and. Building a resale business can be a good way to increase your income. For example, selling used clothes is a good option — aside from decluttering your own. To address this, do what you are good at and outsource what you're iphone4-apple.ru could look into hiring accountants or managers to build up your team. Outsourcing can. Become a freelance writer One of the best ways to make extra money is by leveraging skills you already have and turning them into a business. If you're a. 1. Evaluate yourself objectively · 2. Think of a side business idea · 3. Research stage · 4. Formulate an informal plan · 5. Get feedback · 6. Commit to idea · 7. Turn your hobby snapping photos into a profitable side gig. Make extra cash on weekends shooting weddings or sporting events, or by selling framed or canvas. Be proactive. Nobody can do this for you, but you won't be able to do it all on your own, either. Your ability to problem-solve. Yes, people will pay to have someone watch their house. A side hustle that almost anyone can do, house sitting can be as simple as watering the plants and. -If you have strong knowledge of Social Media. Find companies who does not have a strong social media/web presence and help build a social media presence. You. Offer graphic design services. Home cleaning. Start a drone business. Data entry. Sell your creativity by thinking of domain. If you need a side job to create extra income, read this list of viable side jobs to create your own schedule and break out of the 9-to-5 grind.

Who Is Eligible For A Solo 401k

To be eligible for a Solo (k), you must meet certain criteria. First, you must be self-employed or have self-employment income from a. A solo (k), also called an individual (k) or solo-k, is specifically geared for the self-employed and/or small business owners who do not have full-time. A self-employed (k)—sometimes called a solo(k) or an individual (k)—is a type of savings option for small-business owners who don't have any employees. An Individual (k) or Solo (k) is a flexible retirement plan designed for self-employed small business owners. Open an account with Merrill today. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. You must meet 2 requirements to open a Solo k: 1) Entrepreneurship – This can be working as a freelancer, independent contractor, or business owner. This can. A solo (k) is a retirement account for anyone who is self-employed or owns a business or partnership with no employees apart from a spouse. A Solo (k) is a (k) qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the. First, you must be self-employed or have self-employment income from a business that you own. This includes freelancers, consultants, sole. To be eligible for a Solo (k), you must meet certain criteria. First, you must be self-employed or have self-employment income from a. A solo (k), also called an individual (k) or solo-k, is specifically geared for the self-employed and/or small business owners who do not have full-time. A self-employed (k)—sometimes called a solo(k) or an individual (k)—is a type of savings option for small-business owners who don't have any employees. An Individual (k) or Solo (k) is a flexible retirement plan designed for self-employed small business owners. Open an account with Merrill today. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. You must meet 2 requirements to open a Solo k: 1) Entrepreneurship – This can be working as a freelancer, independent contractor, or business owner. This can. A solo (k) is a retirement account for anyone who is self-employed or owns a business or partnership with no employees apart from a spouse. A Solo (k) is a (k) qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the. First, you must be self-employed or have self-employment income from a business that you own. This includes freelancers, consultants, sole.

The solo (k) is a retirement savings option for small businesses whose only eligible participants in the plan are the business owners. A solo (k) is a retirement account for anyone who is self-employed or owns a business or partnership with no employees apart from a spouse. · In , the. Solo (k) plans allow self-employed business owners to increase their retirement savings contributions versus an IRA. The Self-Directed Solo k plan is an IRS-approved and qualified k plan designed for a self-employed sole proprietor, a corporation, or limited liability. Who Qualifies for a Solo (k) Plan? · No Full-Time Employees · No Employees in Other Businesses · Both an Employee and Self-Employed · Multiple-Employer Plans. The bar for being eligible to contribute to a solo k is actually pretty low: as long as you have self-employment income you may contribute to a solo k. Are there any other considerations or administration requirements? Yes, once the Solo (k) balance exceeds $, at the end of the year, the IRS does. Only the first $, in net self-employment income counts for the year, and the total amount you may contribute to your solo (k) as employee and employer. A Solo (k) plan is a (k) qualified retirement plan designed specifically for business owners and their spouse. In order to qualify for a solo(k) you must be self-employed with no other full-time employees. 4. Roth & Traditional Accounts. A solo (k) can have both. An Individual (k) plan is available to self-employed individuals and business owners, including sole proprietors, owner-only corporations, partnerships, and. A Self-Employed (k) plan is a profit-sharing plan with a salary deferral arrangement, qualified under Internal Revenue Code Eligibility. Who is a Self-. Who is eligible for an individual or solo (k) plan? Generally, only businesses that consist of an owner and a spouse, if that individual also works for the. How do I qualify for a solo k plan? In a nutshell you need to be performing at minimum part-time self-employment activity in order to open and continue. The rules to qualify for a Solo (k) are straightforward and more flexible than a Simple IRA account. A person must have self-employment income from their. A solo (k) shares all the characteristics of any other (k) plan, but it only covers the business owner and their spouse. Solo (k) eligibility criteria. If you do have part-time employees or seasonal help, they must work 1, hours or less for you to be eligible to create a solo (k). Being a sole proprietor. If there are no other eligible employees, just those two partners participating, then it would still qualify as a “single-participant plan” (solo k) with. So from what I can tell, if you are self employed, and have an EIN you can open a Solo k. If I am employed by a company not owned by. To be eligible, you need to satisfy two requirements: the presence of self-employment activity and the lack of full-time employees. You can make contributions.

Rich And Single

iphone4-apple.ru Then you can talk to them.. We have focused on the rich & millionaire dating service for 16 years(since ), we have over 3. Rich Men, Single Women Three gal pals hatch a plot to "convince three rich, lucky men" to marry them. Paige: Suzanne Somers. Tori: Heather Locklear. Susan. The experience of being rich and single is either being lonely or happy. It all depends on the person. Perhaps I would stay single like Leonardo. Meet affluent singles seeking love and luxury on EliteSingles' rich dating app. Join our platform today and find your match! Even if you got it all, you won't get someone if you lack humility. There are beautiful, rich, but still single people all around who need to improve. RICH, SINGLE & SEXY (The Ultimate Book 4) eBook: Wilson, Mary Anne: iphone4-apple.ru: Kindle Store. 12 Billionaires Who are Single · Kim Kardashian · Elaine Wynn · Jack Dorsey · Laurene Powell Jobs · Mikhail Prokhorov · Alice Walton · Leslie Alexander · David Thomson. Followers, Following, 89 Posts - Dating with rich single (@datingwithrichsingle) on Instagram: "Best way to Date a millionaire here. Finding a life partner is my dream. I don't care if he's ugly or handsome,rich or poor to me which is important to be loyal. iphone4-apple.ru Then you can talk to them.. We have focused on the rich & millionaire dating service for 16 years(since ), we have over 3. Rich Men, Single Women Three gal pals hatch a plot to "convince three rich, lucky men" to marry them. Paige: Suzanne Somers. Tori: Heather Locklear. Susan. The experience of being rich and single is either being lonely or happy. It all depends on the person. Perhaps I would stay single like Leonardo. Meet affluent singles seeking love and luxury on EliteSingles' rich dating app. Join our platform today and find your match! Even if you got it all, you won't get someone if you lack humility. There are beautiful, rich, but still single people all around who need to improve. RICH, SINGLE & SEXY (The Ultimate Book 4) eBook: Wilson, Mary Anne: iphone4-apple.ru: Kindle Store. 12 Billionaires Who are Single · Kim Kardashian · Elaine Wynn · Jack Dorsey · Laurene Powell Jobs · Mikhail Prokhorov · Alice Walton · Leslie Alexander · David Thomson. Followers, Following, 89 Posts - Dating with rich single (@datingwithrichsingle) on Instagram: "Best way to Date a millionaire here. Finding a life partner is my dream. I don't care if he's ugly or handsome,rich or poor to me which is important to be loyal.

Rich Men, Single Women: Directed by Elliot Silverstein. With Suzanne Somers, Heather Locklear, Deborah Adair, Larry Wilcox. Three women plot to catch. Listen to Already Rich on Spotify · Single · Yeat · · 1 songs. Your best days are the ones you're living now.” Rich Wilkerson, Jr., has encouraged, counseled and led thousands of individuals through the different seasons. This Single and rich bully that needs a lot of boy is a roleplayer Albert met in the "Roblox admin gave noobs WEAPONS to see what they'd do " video. A personal finance, parenting, and personal development single mom money blog for single moms who want to thrive and not just survive! A personal finance, parenting, and personal development single mom money blog for single moms who want to thrive and not just survive! MillionairesClub is a top-tier millionaire dating website designed to connect men free women of similar income and wealth. I've been empowering single moms to thrive financially and emotionally. I'm here to show you how to take control of your life, no matter your circumstances. Followers, 18 Following, 37 Posts - Rich Single Men (@iphone4-apple.ru) on Instagram: "Rich Men Life, Meet Rich Men". In essence, the lives of rich single women are a tapestry woven from ambition, compassion, and a deep-seated desire to lead fulfilling lives. By embracing their. Oct 25, - Explore Ambrose Ndege's board "Rich single women" on Pinterest. See more ideas about rich single women, single women, women looking for men. The rinse repeat continues for a long time till they decide to stay single but continue to follow bikini models or other naked women on social media to let. How To Marry Mr. Rich: How To Find A Single Man Who Is Making $+ Plus A Year: Summers, Melody: Books - iphone4-apple.ru Rich Men, Single Women Rich Men, Single Women is a American made-for-television romantic comedy film directed by Elliot Silverstein. In our latest study, iphone4-apple.ru sought the best cities to find single rich women (for the best cities to find single rich men, click here). rich men looking for women. millionaires, wealthy men are looking for Relationship status: Single Millionaire/Annual income: $,+ Man, 36 San. No single human needs or deserves this much wealth. richest Americans ($ trillion). $80 million. Jeff Bezos may be insanely. M posts. Discover videos related to Usa Rich Single Women Looking for Men on TikTok. See more videos about Single Rich Woman Looking for Men. That's because, to save money, he would get a motel room with 2 single beds—for a family of 6. Then, once he got the key, we would quietly go into the room. There are many good men out there on the single market looking rich women to date but are faced with the issue of meeting them. Internet dating services.

Best Investments In World

But in today's investing world “adding international exposure is one of the first steps toward a diversified portfolio,” according to Morningstar portfolio. We are proud to be recognized as the Best Investment Bank in Canada as part of Euromoney's Awards of Excellence in Global Investment Banking. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page. INVESTING ADVICE · Top Performers. These companies have seen the highest growth in performance over the past year. · Earnings Stalwarts. Earnings Stalwarts stocks. The equity investments are spread across 9, companies to capture global value creation and diversify risk as best possible. About 70 percent of the fund is. As Canada's investment promotion agency, we connect businesses with resources and programs to support their growth plans. we are. Canada is one of the world's top destinations for foreign direct investment. Invest in Canada works directly with global businesses to help them expand. Stocks are considered the best investment in terms of historical rate of return, outperforming other instruments, including bonds. But in today's investing world “adding international exposure is one of the first steps toward a diversified portfolio,” according to Morningstar portfolio. We are proud to be recognized as the Best Investment Bank in Canada as part of Euromoney's Awards of Excellence in Global Investment Banking. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page. INVESTING ADVICE · Top Performers. These companies have seen the highest growth in performance over the past year. · Earnings Stalwarts. Earnings Stalwarts stocks. The equity investments are spread across 9, companies to capture global value creation and diversify risk as best possible. About 70 percent of the fund is. As Canada's investment promotion agency, we connect businesses with resources and programs to support their growth plans. we are. Canada is one of the world's top destinations for foreign direct investment. Invest in Canada works directly with global businesses to help them expand. Stocks are considered the best investment in terms of historical rate of return, outperforming other instruments, including bonds.

Denmark is one of the world's top locations for tech activities, featuring an excellent test market with access to world-class software development talent. investment volumes and groundbreaking innovations in the investment IFC — a member of the World Bank Group — is the largest global development institution. world's largest institutional investors timely insights and access to deep global investment capabilities Equities are typically best for long-term investing. Canada is home to many great companies that make excellent investments. But the world has so much more to offer for investors who venture beyond Canada's. The 10 Best Companies to Invest in Now ; Yum China. Price/Fair Value: · Industry: Restaurants ; Estee Lauder. Price/Fair Value: · Industry: Household and. Best in class. The best-in-class approach for sustainable investing means finding the companies that are leaders in their sector in terms of meeting. Cultivating great investment minds. Our investment products are managed by a select group of asset managers from around the world. TOP ; GEV · Ge Vernova Inc. % ; WDC · Western Digital Corp. % ; TSLA · Tesla Inc. %. We put the world's leading investment managers to work for you. Awards. When you invest, it's good to know you're among the best. Insights. Up-to-date with. However, on a year-on-year basis, global FDI flows remained comparable to the level recorded in Q1 Top recipients of FDI inflows worldwide in the first. Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy PolicyTerms & Conditions. Copyright © Rule 1 Investing. All rights reserved. Investing on yourself is the best investment in the world right now learn high demand skills this is the best investment you do in your. Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News. The UK has a mature, high-spending consumer market and an open, liberal economy, world-class talent and a business-friendly regulatory environment. world, through funds, co-investments and direct ownership. We can manage best investment opportunities across the world. Each year, we review our. The Goldman Sachs Group, Inc. is a leading global investment banking, securities, and asset and wealth management firm that provides a wide range of. Beat the market with the 20 top-performing stocks selected by our advanced AI and poised to outperform the S&P The vision of our economic strategy, Calgary in the New Economy, is to be the city of choice for the world's best entrepreneurs who embrace technology to solve. With a year annualized rate of return of % from fiscal to , CPP Investments ranked first among national pension funds, and second only to New. Context. New global shocks could threaten investment in unprecedented ways with repercussions for economic growth and development. Global foreign direct.

Chase Bank Limit

Certain restrictions and other limitations may apply. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Follow us. Deposit and credit card products provided by JPMorgan Chase Bank, N.A. Member FDIC You may also wish to use other available online tools to limit various. It depends what the branch has on hand. They will do 5k for you no problem, just call in advance to ensure you get all s. Make sure you have both debit card. limits and funds are typically available by the next business day. Deposit Trust and Fiduciary services including custody are offered through JPMorgan Chase. The two Chase Sapphire cards have the highest credit limits, and its Chase Freedom Unlimited® offering can provide a relatively high credit limit for a no-. Premier Plus Checking customers get four ATM fees charged by Chase for non-Chase Bank ATMs waived per statement period. The bank limits customers to one bonus. A credit card limit — also known as a credit line — is the maximum amount that a person can spend on their card, set by the credit card issuer. The two Chase Sapphire cards have the highest credit limits, and its Chase Freedom Unlimited® offering can provide a relatively high credit limit for a no-. For Chase ATMs outside of your branch, you can withdraw up to $1, per day. Non-Chase ATMs allow you to withdraw up to $ per day. Withdrawal limits for. Certain restrictions and other limitations may apply. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Follow us. Deposit and credit card products provided by JPMorgan Chase Bank, N.A. Member FDIC You may also wish to use other available online tools to limit various. It depends what the branch has on hand. They will do 5k for you no problem, just call in advance to ensure you get all s. Make sure you have both debit card. limits and funds are typically available by the next business day. Deposit Trust and Fiduciary services including custody are offered through JPMorgan Chase. The two Chase Sapphire cards have the highest credit limits, and its Chase Freedom Unlimited® offering can provide a relatively high credit limit for a no-. Premier Plus Checking customers get four ATM fees charged by Chase for non-Chase Bank ATMs waived per statement period. The bank limits customers to one bonus. A credit card limit — also known as a credit line — is the maximum amount that a person can spend on their card, set by the credit card issuer. The two Chase Sapphire cards have the highest credit limits, and its Chase Freedom Unlimited® offering can provide a relatively high credit limit for a no-. For Chase ATMs outside of your branch, you can withdraw up to $1, per day. Non-Chase ATMs allow you to withdraw up to $ per day. Withdrawal limits for.

Today, there's no limit to the number of withdrawals or transfers you can make from your Chase savings account Like many other banks, Chase used to charge a. What is the maximum amount I can withdraw from an ATM using my debit card? Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). Have a Chase College Checking account linked to this account for overdraft protection. Are under There is a $5 Savings Withdrawal Limit Fee which applies to. The maximum total deposit for J.P. Morgan Premium Deposit is $3 million per account. b. Chase Bank limits. All deposits at Chase Bank held in the same. Learn how to adjust your transaction limit amounts for your profile in just a few steps. Any transactions over this limit will have a $5 fee, which can be waived for Premier accounts with a minimum balance of $15, JPMorgan Chase Bank Savings vs. There is no limit to how much you can pay into your Chase current account. Most payments are available almost immediately, although they can sometimes take up. Your cash advance limit designates the maximum amount of money Chase has NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR. Debit card purchases are limited to $3, per day. ATM withdrawals have several restrictions, depending on the ATM: Chase in-branch ATM limit: $3,; Other. With a Chase Private Client debit card, you can withdraw up to $2, from non-Chase ATMs. What Is the Maximum Deposit Limit for Chase ATMs? There's no limit to. No fees on everyday banking · Preferred rates and exclusive perks · Higher limits · Priority service. Your bank's daily ATM withdrawal limits ; Chase. Up to $3, ; Chime®. $ ; Citi®. $1, to $2, ; Discover® Bank. $ You can use your numberless card to make free withdrawals at any Chase Bank ATM in the United States. If travelling abroad, there is also a £1, limit on. Chase Online Bill Pay: Must enroll in Chase Online℠ Banking and activate Online Bill Pay. Certain restrictions and other limitations may apply. Footnote 7. Daily withdrawal limits cap at $ for non-Chase ATMs ($1, for Connecticut, New Jersey and New York), $1, for Chase ATMs and $3, for in-person. Set up a recurring allowance to give your child money to spend or save. Step one After signing into your Chase Mobile® app, tap the Chase First Banking account. Say, for example, your bank's ATMs only accepts a maximum of 40 bills — the cash deposit limit then ranges anywhere between $40 and $4,, depending on the. Have a Chase College Checking account linked to this account for overdraft protection. Are under There is a $5 Savings Withdrawal Limit Fee which applies to. Link your external accounts to make payments or transfers · Step one Sign in to your Chase Mobile® app and swipe left on your checking account · Step two Tap ".

Refinance Private Student Loans To Federal

Yes, you can combine private and federal student loans by refinancing them with a private lender. Through this process, you actually apply for a new loan. Refinancing your private student loans can be a great way to reduce your interest rate and qualify for different repayment terms. This includes combining your. When you refinance your federal or private student loan debt with MEFA, you will lose current and future benefits, as well as any protections, associated with. Another option for federal student loans is a direct consolidation loan, which combines multiple loans into one loan. However, federal consolidation will not. With refinancing, you can consolidate the existing private and federal student loans into a new loan with a lower interest rate. That means lower monthly. Be careful refinancing federal student loans into private student loans, since you will lose some of your federal benefits such as Public Service Loan. Competitive interest rates · % interest rate reduction when you sign up for automatic payments · Loans for multiple children can be combined · Refinance before. Refinance your private student loans and refinance your federal student loans together. With LendKey you can consolidate your loans into one convenient. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily. Yes, you can combine private and federal student loans by refinancing them with a private lender. Through this process, you actually apply for a new loan. Refinancing your private student loans can be a great way to reduce your interest rate and qualify for different repayment terms. This includes combining your. When you refinance your federal or private student loan debt with MEFA, you will lose current and future benefits, as well as any protections, associated with. Another option for federal student loans is a direct consolidation loan, which combines multiple loans into one loan. However, federal consolidation will not. With refinancing, you can consolidate the existing private and federal student loans into a new loan with a lower interest rate. That means lower monthly. Be careful refinancing federal student loans into private student loans, since you will lose some of your federal benefits such as Public Service Loan. Competitive interest rates · % interest rate reduction when you sign up for automatic payments · Loans for multiple children can be combined · Refinance before. Refinance your private student loans and refinance your federal student loans together. With LendKey you can consolidate your loans into one convenient. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily.

Refinance and consolidate private and federal student loans (including PLUS loans), setting up one convenient payment and potentially lowering your rate. You can refinance federal student loans, but only with a private lender, as the US Department of Education doesn't offer refinance loans. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. Just remember, when you refinance federal student loans into a private refi loan, you'll lose access to any current or future federal benefits, such as. Refinancing student loans may add up to significant savings. For example, if you refinance multiple loans into one loan with a lower rate, and keep the loan. Refinancing vs consolidating student loans · Consolidation means combining multiple loans into a single one. · Refinancing means getting a new loan from a private. Just remember, when you refinance federal student loans into a private refi loan, you'll lose access to any current or future federal benefits, such as. Refinancing your student loans is when you take out a new loan to pay off your old loans, leaving you with just one loan and payment to manage. Depending on. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. For federal and private student loans, you can obtain a private refi, which pays off the old loans with a new private student loan. The interest rate on the. Please note that you may lose benefits associated with your underlying federal loans, such as federal Income-driven Repayment Plans (an example of which is the. Refinancing is available for both federal and private student loans, although the process may differ depending on which loan types you have. It's also important. While you can't consolidate private loans into a federal loan, if you have both private and federal loans, you can consolidate the private ones with a private. Refinancing is offered by some banks, credit unions and other specialized student loan lenders. This type of loan allows you to combine federal and/or private. For borrowers who have loans that are owned by the U.S. Department of Education, the only option is to refinance through a private lender, like a big bank. Refinancing combines federal and/or private loans into a single new loan. · Consolidating combines federal loans into a single new loan amount. · The decision to. Can I refinance both my federal and private loans with 1st Advantage? associated with your federal student loans by refinancing with a private loan. Student Loan Consolidation: Primarily offered by the government for federal student loans, consolidation is the act of combining multiple federal student loans. The federal government does not offer refinancing for federal student loans, and refinancing these loans with a private lender will leave you ineligible for. Consolidation typically refers to combining your federal student loans into one new federal loan with a new term. It does not necessarily provide a lower.