iphone4-apple.ru

Learn

How You Borrow Money From Cash App

Tap the profile icon on your Cash App home screen Scroll down and tap Cash Support Tap Adding Money Scroll down and tap Borrow Tap Contact. Control how you spend, budget, and deposit money with the Dave Checking account. If you're short on cash, you've got options. Take Surveys that pay out. Start by tapping the green-and-white dollar sign on your Android, iPhone, or iPad's app list. 1. You will have to qualify. Cash advance apps may not pull your credit but you will need to connect your bank account to see if you can repay them. 3. Cash. To borrow money from Cash App, open the app, go to your balance,[━━△━━━━△━━] tap "Borrow" if available, select the amount, review terms, and accept. How to use Cash App Borrow · Open the Cash app. · Tap on your Cash app balance in the lower-left corner. · Go to the “Banking” header. · Check. 1. Open Cash App: · 2. Navigate to the Banking Tab: · 3. Find the Borrow Option: · 4. Tap on Borrow: · 5. Review the Terms: · 6. Accept and Borrow: · 7. Repayment. With Cash App Borrow, you can get access to instant loans in minutes, helping you to save time and money. If you're looking for a way to quickly and. United States. Cash App Terms of Service · Cash App Terms of Service (accounts created prior to June 24, ) · Cash Sutton Bank Terms of Service. Tap the profile icon on your Cash App home screen Scroll down and tap Cash Support Tap Adding Money Scroll down and tap Borrow Tap Contact. Control how you spend, budget, and deposit money with the Dave Checking account. If you're short on cash, you've got options. Take Surveys that pay out. Start by tapping the green-and-white dollar sign on your Android, iPhone, or iPad's app list. 1. You will have to qualify. Cash advance apps may not pull your credit but you will need to connect your bank account to see if you can repay them. 3. Cash. To borrow money from Cash App, open the app, go to your balance,[━━△━━━━△━━] tap "Borrow" if available, select the amount, review terms, and accept. How to use Cash App Borrow · Open the Cash app. · Tap on your Cash app balance in the lower-left corner. · Go to the “Banking” header. · Check. 1. Open Cash App: · 2. Navigate to the Banking Tab: · 3. Find the Borrow Option: · 4. Tap on Borrow: · 5. Review the Terms: · 6. Accept and Borrow: · 7. Repayment. With Cash App Borrow, you can get access to instant loans in minutes, helping you to save time and money. If you're looking for a way to quickly and. United States. Cash App Terms of Service · Cash App Terms of Service (accounts created prior to June 24, ) · Cash Sutton Bank Terms of Service.

Brigit: Fast Cash Advance 4+. Credit, Budgeting & Saving App. Brigit Inc. Designed for iPad. #26 in Finance. Cash App is a mobile app that lets you borrow money from peers. You can borrow up to $, and repayment is easy with a flat fee of 5%. Access up to $ of your hard-earned cash exactly when you need it. No interest. No credit check. No mandatory fees. Available in minutes for a fee1, or. To borrow money from Cash App on Android, open the app, tap on the "Money" tab, scroll down and select the "Borrow" option, unlock the Borrow. To borrow money from Cash App, use the "Borrow" feature by opening the app, tapping on your balance, and selecting “Borrow.” If eligible, you can. Step 1 Tap the banking tab at the bottom-left corner of Cash App. · Step 2 Tap Borrow. Get a Cash Advance loan today for short-term expenses? Borrow $ – $1, Fast, easy application. (Not available in Newfoundland and Labrador, New. Yes, you can borrow money from Cash App! Cash App offers loans of between $20 and $ The company's loans will cost you 5% of the loan balance immediately. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app. 10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an. In this comprehensive guide, we will walk you through the process of borrowing money from Cash App on your Android device step-by-step. Borrowing money from Cash App can be convenient, but it's crucial to use this feature responsibly. Always review the terms and make sure you Cash App offers short-term, low-interest loans of between $20 and $, but not everyone qualifies. Here's how to unlock Cash App Borrow, the fees you'll pay. Tap the profile icon on your Cash App home screen Scroll down and tap Cash Support Tap Adding Money Scroll down and tap Borrow Tap Contact. Cash App will let you borrow money, but only if you're one of the few accounts in the US and Canada that are currently allowed to tet the option. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term loan. Cash Money offers lines of credit and payday loans both online and in store. Get the cash you need fast with our convenient loan stores near you in Canada. With Cash App Borrow, you can get access to instant loans in minutes, helping you to save time and money. If you're looking for a way to quickly and. Cash App + offers a feature called "Borrow" that lets you take out a small loan. Borrow money from Cash App To access it, open the app. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as.

The Best Hydrolyzed Collagen Powder

However you enjoy it, you're sure to enjoy our value: Trader Joe's Hydrolyzed Collagen Powder is three dollars less than the brand we previously offered on our. Pasture raised, grass-fed, % natural hydrolyzed collagen packed with premium-quality protein and 18 amino acids. Made in the USA. Collagen supplements: Jamieson With g of hydrolyzed collagen per tablet, Jamieson Collagen Anti-Wrinkle is clinically proven to reduce wrinkles and fine. Strawberry Watermelon Collagen Powder - g - The Collagen Co. Best Seller Hydrolyzed Collagen Peptides (Bovine). Hydrolyzed bioactive collagen from. Features · % HYDROLYZED COLLAGEN: Contains Type I & Type III Collagen. · MULTIPLE BENEFITS: Improves skin health, gut function & digestion, supports joint. $ · Pure Hydrolyzed Collagen (contains type I and type III collagen) · Sourced exclusively from Brazilian Pasture Raised (Grass Fed) Cows · All Natural. MO4T Premium Multi Collagen Powder -Type 1,2,3,5,10 -Sugar-Free, Keto-Friendly Oz Youtheory Advanced Collagen - 6, mg Collagen - with Vitamin C -. With our powder formula, you're getting pure hydrolyzed bovine Collagen, nothing else. Its neutral flavor profile mixes perfectly into food and drink. And. In this video, we unveil the best, dermatologist-recommended collagen powder that promises to enhance your skin's elasticity, hydration. However you enjoy it, you're sure to enjoy our value: Trader Joe's Hydrolyzed Collagen Powder is three dollars less than the brand we previously offered on our. Pasture raised, grass-fed, % natural hydrolyzed collagen packed with premium-quality protein and 18 amino acids. Made in the USA. Collagen supplements: Jamieson With g of hydrolyzed collagen per tablet, Jamieson Collagen Anti-Wrinkle is clinically proven to reduce wrinkles and fine. Strawberry Watermelon Collagen Powder - g - The Collagen Co. Best Seller Hydrolyzed Collagen Peptides (Bovine). Hydrolyzed bioactive collagen from. Features · % HYDROLYZED COLLAGEN: Contains Type I & Type III Collagen. · MULTIPLE BENEFITS: Improves skin health, gut function & digestion, supports joint. $ · Pure Hydrolyzed Collagen (contains type I and type III collagen) · Sourced exclusively from Brazilian Pasture Raised (Grass Fed) Cows · All Natural. MO4T Premium Multi Collagen Powder -Type 1,2,3,5,10 -Sugar-Free, Keto-Friendly Oz Youtheory Advanced Collagen - 6, mg Collagen - with Vitamin C -. With our powder formula, you're getting pure hydrolyzed bovine Collagen, nothing else. Its neutral flavor profile mixes perfectly into food and drink. And. In this video, we unveil the best, dermatologist-recommended collagen powder that promises to enhance your skin's elasticity, hydration.

Reach your wellness goals with the benefits of Great Lakes Wellness collagen hydrolysate. It's a simple and effective way to improve joint health. Get the benefits of a complete collagen recovery from a powdered blend that contains 15 grams of grass-fed collagen peptides and none of those unhealthy. Counting down the best collagen powder brands currently on the market! This review is NOT SPONSORED, this is honest feedback on each: Links. Pure collagen powder that delivers. An easy, effective way to improve overall health and strength. - Supports healthy skin and minimizes the appearance of. Perfect Hydrolyzed Collagen has such a low molecular weight that it is over 90% Bioavailable and instantly dissolves in any liquid - hot or cold. This Multi Collagen Protein Powder is tested in an ISO Certified Lab to ensure we are giving you the best of the best. It is made with absolutely NO Fillers. Postoperative healing is important to me and Collagen peptide powder is a perfect addition to my plan. I will be continuing this product for good. Coming. With g of hydrolyzed collagen per tablet, Jamieson Collagen Anti-Wrinkle is clinically proven to reduce wrinkles and fine lines in 28 days by providing. Hydrolyzed collagen should be taken if a person wants to take a collagen supplement. Hydrolyzed collagen means the collagen has been broken down into small. Best of the Bone Multi-Collagen hydrolysed peptides provide seven collagen types into the highest quality grass-fed collagen powder that benefits skin. In my Opinion, this is best collagen peptides supplement to use is the Sports Research Organic Collagen Peptides. Multi Collagen Complex: Hydrolyzed Bovine Hide Collagen Peptides, Fermented Eggshell Membrane Collagen, Chicken Bone Broth Protein Concentrate, Bacillus. Hydrolyzed collagen should be taken if a person wants to take a collagen supplement. Hydrolyzed collagen means the collagen has been broken down into small. Reach your wellness goals with the benefits of Great Lakes Wellness collagen hydrolysate. It's a simple and effective way to improve joint health. With g of hydrolyzed collagen per tablet, Jamieson Collagen Anti-Wrinkle is clinically proven to reduce wrinkles and fine lines in 28 days by providing. Hydrolyzed Collagen Peptides Powder - Unflavored (41 Servings) ; Tyrosine, 55 MG, N/A* ; Valine, MG, N/A* ; Other Ingredients: Grass-Fed Pasture Raised Bovine. Your Search For The Best Collagen On The Planet Ends Here We know, that is a very bold statement. After all, there are a number of good collagen supplements. 3. The top hydrolyzed collagen supplement. As you may have picked up after reading this far, the top collagen supplements are hydrolyzed. In fact, the. Amount Per Serving, % Daily Value ; Calories. 25 ; Protein (from hydrolyzed collagen Types 1 and 3). 6 g ; Hydrolyzed Collagen Types 1 and 3 g. g. †. Each serving provides 12 grams of hydrolyzed collagen, ensuring better absorption and maximum benefits. Revive Collagen primarily offers Type I and Type III.

Apps To Earn Money For Playing Games

AppStation is an Android app that lets you earn money every minute you spend playing games, taking surveys or referring friends. When you accumulate $5 in. Cash Cow. 5 - Have you ever wanted to earn money or gift cards while playing games? It's time to get lucky and get the money you deserve for playing!???? Justice Poker and League11 are the best options for money-making game apps but it's important to approach money-making apps with a critical eye. Mistplay delivers a great platform for gamers and game lovers by rewarding them with real money in return for playing and completing in-game challenges and. JustPlay enables players around the world to be rewarded daily for the time they invest in playing games they love. We consider this a new paradigm in digital. Top Free Games to Play and Earn Real Money on Swagbucks Now · Solitaire Cash: Deposit $5 and play at least 3 games, receive $ · Blackout Bingo: Install the app. To earn money with Mistplay, you need to download the free app (only available for Android, but coming to iOS in the future), then select games to install and. Play store for mobile games income or money that apps earn from an in-app purchase. Game apps advertising revenue is the money apps earned from in-game. Mistplay is a platform that allows you to earn real money by playing various games. While some games may require in-. AppStation is an Android app that lets you earn money every minute you spend playing games, taking surveys or referring friends. When you accumulate $5 in. Cash Cow. 5 - Have you ever wanted to earn money or gift cards while playing games? It's time to get lucky and get the money you deserve for playing!???? Justice Poker and League11 are the best options for money-making game apps but it's important to approach money-making apps with a critical eye. Mistplay delivers a great platform for gamers and game lovers by rewarding them with real money in return for playing and completing in-game challenges and. JustPlay enables players around the world to be rewarded daily for the time they invest in playing games they love. We consider this a new paradigm in digital. Top Free Games to Play and Earn Real Money on Swagbucks Now · Solitaire Cash: Deposit $5 and play at least 3 games, receive $ · Blackout Bingo: Install the app. To earn money with Mistplay, you need to download the free app (only available for Android, but coming to iOS in the future), then select games to install and. Play store for mobile games income or money that apps earn from an in-app purchase. Game apps advertising revenue is the money apps earned from in-game. Mistplay is a platform that allows you to earn real money by playing various games. While some games may require in-.

Play video games for money - Madden, EA FC, EA Sports College Football, NBA2K, FIFA, NHL, COD, Fortnite & more. Compete in online tournaments on XBox, PS5. Mistplay is a popular app that lets you earn by playing fun mobile games. · Swagbucks is a versatile platform that rewards you for doing various. Earn Razer Silver simply by playing featured PC game titles on Razer Cortex: PLAY TO EARN! Earn 5 Razer Silver for every minute of gameplay. Compete for cash prizes playing video games like Madden, NBA 2K, FIFA, Call of Duty, Fortnite, Apex, Clash Royale and more. · Two apps, earn your way · How. There are many game apps that can help you earn real money and some of the top game apps are KashKick, Bingo Cash, Blackout Bingo, Solitaire Cash, and Mistplay. Rewarded video ads. Popular among gaming apps, rewarded video ads help app makers earn money without annoying pop-ups or banners. Instead, these ads let. There are games on the mobile phone through which you can earn money in dollars, and I play these games and transfer the money via my PayPal account. Mistplay: An app that pays you to play new games. You earn points that can be converted into gift cards or cash through linked accounts. Swagbucks: While. The #1 loyalty program for mobile gamers. Discover games you'll love, and earn free gift cards for playing. Download Mistplay today! Sounds great right? Well, all you have to do is to download the BUFF app and let it run in the background and you will start earning BUFFs. app, If you like playing games & enjoy the ones with offers then it's ok I suppose as you make points while enjoying the games,. The only reason I am marking. Our article reveals ideas and quick ways to play games to earn money. Whatever your idea, there's always something that will suit you from our shortlist. Meet Buff, the ideal gamer's reward program. Game, earn Buffs, get Items, and Capture your Highlights. Welcome home, gamer. Win Real Money Online with Game Champions | The #1 Social Gaming Platform with Free Tournaments, Skill Gaming Competitions and Instant withdrawals. Mistplay is an app that pays you to play games on your phone! You can earn gift cards, cash via PayPal, and more. It likely won't become your. Play games to earn money on Mistplay. Mistplay is another app that pays you to play games on your phone. All you have to do is download the app and start. This article briefly elucidates the best games to play to earn money and how people can take advantage of this opportunity. 1. Cointiply: Earn money in Bitcoin · Play games · Install Apps · Filling surveys · View ads. BigCash is the best app to earn money while playing games. You get 20+ games in different categories. You can play the card games such as Poker, Rummy, and Call. This article briefly elucidates the best games to play to earn money and how people can take advantage of this opportunity.

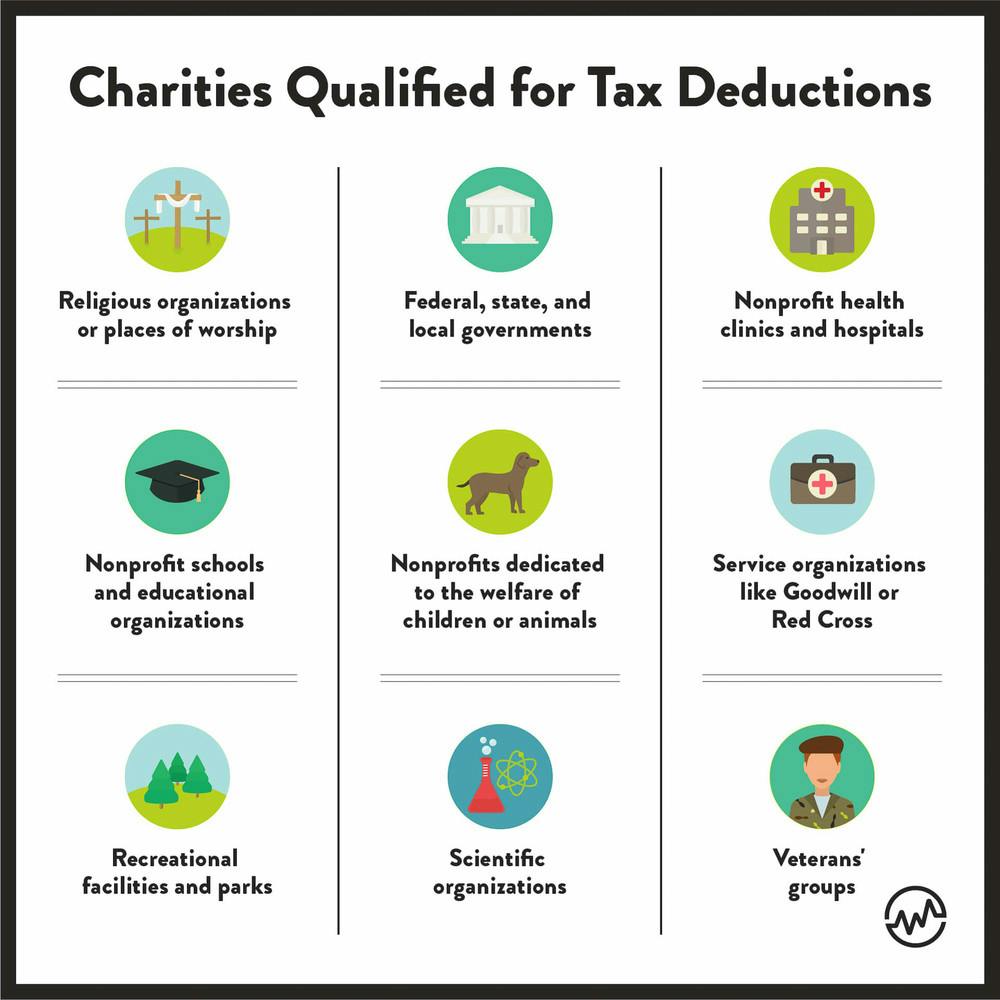

How Much Charity Deduction Is Reasonable

These can be made by check, credit card or even payroll deduction through your employer. If you itemize deductions, gifts of cash to qualified public charities. Federal law does not allow for charitable donations through payroll deduction (CFC or any other payroll deduction program) to be done pre-tax. Donors who. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. reasonable estimate—of the percentage that will be received by the charity. how much you can deduct on your taxes for a donated vehicle. The Official. How does charitable giving affect taxes? Charitable donations can help reduce both your tax bill and taxable income, all while contributing to a worthy cause. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so. Many nonprofit institutions are exempt from paying federal income tax, but taxpayers may deduct donations to organizations set up under Internal Revenue Code. 6. There are limits to how much you can deduct. The rule of thumb is that you can deduct up to 60% of your adjusted gross income through charitable donations. Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income (AGI), though in some cases, limits of 20%, 30%, or 50% may apply. These can be made by check, credit card or even payroll deduction through your employer. If you itemize deductions, gifts of cash to qualified public charities. Federal law does not allow for charitable donations through payroll deduction (CFC or any other payroll deduction program) to be done pre-tax. Donors who. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. reasonable estimate—of the percentage that will be received by the charity. how much you can deduct on your taxes for a donated vehicle. The Official. How does charitable giving affect taxes? Charitable donations can help reduce both your tax bill and taxable income, all while contributing to a worthy cause. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so. Many nonprofit institutions are exempt from paying federal income tax, but taxpayers may deduct donations to organizations set up under Internal Revenue Code. 6. There are limits to how much you can deduct. The rule of thumb is that you can deduct up to 60% of your adjusted gross income through charitable donations. Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income (AGI), though in some cases, limits of 20%, 30%, or 50% may apply.

If you donate securities instead of cash, you may deduct up to 30% of your AGI. Pretty simple so far, right? Now, what if you want to donate a combination of. Then those funds can be invested for tax-free growth, and you can recommend grants to any eligible IRS-qualified public charity. You want your charitable. The gift of a long-term capital asset qualifies for a charitable tax deduction at fair market value. However, the deduction for a gift of a long-term capital. Rule 1: To qualify for a charitable deduction, University expenses covered by a supporter's contribution must be reasonable and necessary expenses that are. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. Donating to your place of worship, like to any other qualified charity, can be tax deductible if the requirements are met. The most common deduction here is. When you itemize your tax deductions on your return, you can take an income tax deduction for a donation to a (c)(3) charitable organization. The average person donates about $5, per year to charity. That's close to $ per month. This figure was calculated using the 38 million tax returns filed. In , the IRS temporarily allowed taxpayers to deduct up to % of their AGI in charitable gifts. But this special allowance has since expired. How much can. If you take the standard deduction on your return, you cannot claim charitable contributions on your federal return. The standard. Other than cash contributions of up to $, you can only deduct charitable contributions if you itemize your personal deductions instead of taking the standard. You won't get access to the tax benefits of donating to a nonprofit if you take the standard deduction unless the IRS makes an exception for a specific tax year. Itemized deductions directly lower your taxable income. Charitable deductions count as itemized deductions. Say you donate $ in cash. The charity gets $ . Donors, of course, are free to contribute without taking a tax deduction. But federal tax deductions can be claimed only for gifts to recognized (c)(3). The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. How large are individual income tax incentives for charitable giving? A. The individual income tax deduction for charitable giving provides a substantial. The IRS permits a carryover for five tax years, should your charitable deduction exceed AGI limits in a given tax year. To substantiate your charitable income. A donee organization that does not acknowledge a contribution incurs no penalty; but without a written acknowledgment, the donor cannot claim the tax deduction. There is a limit on how much of your charitable donation is tax deductible. For cash, this is 60% of your adjusted gross income or AGI. KEY TAKEAWAYS: To deduct. Depending on the type of donation a charitable deduction is limited to a certain percentage of the taxpayer's adjusted gross income (AGI), either 60, 50, 30 or.

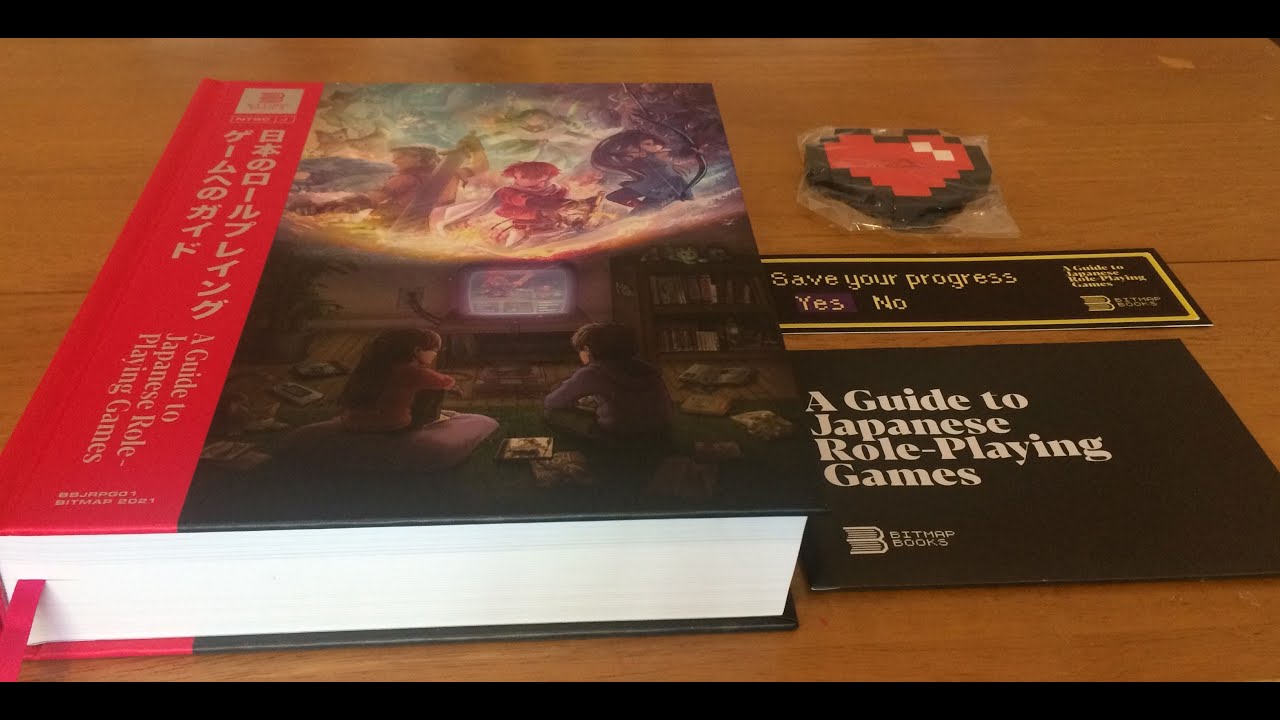

Japanese Roleplay Games

“Twilight Princess” () was the eighth box set to be released for the Japanese version of Call of Cthulhu and the only non-translated item that Hobby Japan. Japanese games · Biohazard (FamiCom) (Resident Evil) () · Lei Dian Huang: Bi Ka Qiu Chuan Shuo (Pokémon Yellow Pikachu) () · Final Fantasy VII (FamiCom) . Japanese role-playing games (abbrev.: JRPG) are traditional and live-action role-playing games written and published in Japan (this excludes role-playing video. A tabletop role-playing game of samurai, spirits, and Japanese folklore. Travel the lands of Nippon resolving the conflicts of tumultuous times. Make your own PC game with RPG Maker. Our easy to use tools are simple Japan. icon-close. RPG Maker MZ available on. Degica Shop. Visit the Degica Shop. While perhaps not receiving every major release, the Nintendo Switch is home to plenty of brilliant Japanese role-playing games, making the hybrid console a. Role-playing games made in Japan made their first appearance during the s. Today, there are hundreds of Japanese-designed games as well as several. A bilingual academic journal about table-top role-playing games and live-action role-plays in and from Japan but in a global context. Role-playing games made in Japan made their first appearance during the s. Today, there are hundreds of Japanese-designed games as well as several. “Twilight Princess” () was the eighth box set to be released for the Japanese version of Call of Cthulhu and the only non-translated item that Hobby Japan. Japanese games · Biohazard (FamiCom) (Resident Evil) () · Lei Dian Huang: Bi Ka Qiu Chuan Shuo (Pokémon Yellow Pikachu) () · Final Fantasy VII (FamiCom) . Japanese role-playing games (abbrev.: JRPG) are traditional and live-action role-playing games written and published in Japan (this excludes role-playing video. A tabletop role-playing game of samurai, spirits, and Japanese folklore. Travel the lands of Nippon resolving the conflicts of tumultuous times. Make your own PC game with RPG Maker. Our easy to use tools are simple Japan. icon-close. RPG Maker MZ available on. Degica Shop. Visit the Degica Shop. While perhaps not receiving every major release, the Nintendo Switch is home to plenty of brilliant Japanese role-playing games, making the hybrid console a. Role-playing games made in Japan made their first appearance during the s. Today, there are hundreds of Japanese-designed games as well as several. A bilingual academic journal about table-top role-playing games and live-action role-plays in and from Japan but in a global context. Role-playing games made in Japan made their first appearance during the s. Today, there are hundreds of Japanese-designed games as well as several.

Chorogaiden - Japanese horror rpg CHOROGAIDEN or Eldritch Story (チョロ外伝) is a tabletop rpg involving classic Japanese horror combined with eldritch. TikTok video from Bitmap Books (@bitmapbooks): “A Guide to Japanese Role. · A Guide to Japanese Role-Playing Games. Japanese Number White/red 16mm Die - RPG Dice Tool Tabletop Roleplay Games Supply CCG Card Board Random Tokens Counters Markers Decision · Item details · Shipping. Ryuutama: Natural Fantasy Roleplay · An Original Japanese Role-Playing Game of Seasons, Wonder and Journeys · Om rollespil. Bitmap Books' ambitious title A Guide to Japanese Role-Playing Games covers the entire history of Japan's influential role-playing video games from. Please confirm your region of residence. Japan. SQUARE ENIX CO., LTD. JAPANESE. North America. SQUARE ENIX, INC. ENGLISH. Europe and Other PAL Territories. The translation of rpg is. How to use rpg in a sentence, with our dictionary. Style and substance: The best Japanese RPGs on PS4 and PS5 · Final Fantasy VII Rebirth · Tales of Arise · Tactics Ogre: Reborn · Star Ocean The Divine Force. Few PC game genres match the staggering variety found in role-playing games. Japanese and Western are the big umbrella categories, which are further. role-playing game; RPG ➜ ロールプレイングゲーム. Example Sentences. Nothing found. Believe it or not, the most popular RPG in Japan is Call of Cthulhu. This will often have more shelf space in your average Japanese gaming store. From taking a quick look at Japanese roleplaying games: 1. Japanese RPGs tend to be built around a particular setting or conceit. This is a full introductory Japanese course and adventure all in one. Master hiragana, basic grammar, and over common words used in anime! Our goal is to support and grow the role-playing hobby in and throughout Japan. We aim to achieve this goal through the running of Society games. BUSHIDO is a role playing game that allows you to adventure on the Misty Isles of Nippon. I'm also a feudal Japan history otaku who lived in Japan and studied. Find Role Playing games tagged JRPG like DELTARUNE, I woke up next to you again., Ignis Universia: Eternal Sisters Saga, Haven: Secret of Caledria. We present to your attention a list of free mobile apps in the JRPG genre. By downloading any of them, you will get pleasant emotions from the game! Few PC game genres match the staggering variety found in role-playing games. Japanese and Western are the big umbrella categories, which are further. From Pokémon and Final Fantasy to lesser-known games like EarthBound, this book shows that the JRPG is a crucial lens onto global game studies and the. We present to your attention a list of free mobile apps in the JRPG genre. By downloading any of them, you will get pleasant emotions from the game!

How Far Back Can You File Back Taxes

How to File Back Taxes. If you owe back taxes, you must file a past-due return with the IRS. Although the process is similar to filing an on-time tax return. Is it too late to file past year taxes? It is not too late to file back taxes. You can use FreeTaxUSA to file taxes from all the way back to Use. You can file back taxes for any year, no matter how far in the past. However, in order to be considered “in good standing” with the IRS, you only need to have. If you fail to file timely, your account will be forwarded to the Division of Collections. An estimate of the amount due may be billed. The maximum penalty is 20 percent of the total tax due. If the return is filed late after a jeopardy assessment has been issued, pursuant to KRS , the. How many years can I go back and file for a refund? You have 3 years from the You do not need to file a Mississippi Individual Income Tax return if you. You can file up to 3 years from the original deadline date. You can e-file up years late. After that, you must mail in paper returns. You may be able to. How long can the IRS collect back taxes? · What other options are there? · Frequently Asked Questions · What To Do Next · We know how the IRS works! If you filed with FreeTaxUSA, you can access and print your returns for the past seven years. Print Prior Year Returns. Request Copy From IRS. If you aren't a. How to File Back Taxes. If you owe back taxes, you must file a past-due return with the IRS. Although the process is similar to filing an on-time tax return. Is it too late to file past year taxes? It is not too late to file back taxes. You can use FreeTaxUSA to file taxes from all the way back to Use. You can file back taxes for any year, no matter how far in the past. However, in order to be considered “in good standing” with the IRS, you only need to have. If you fail to file timely, your account will be forwarded to the Division of Collections. An estimate of the amount due may be billed. The maximum penalty is 20 percent of the total tax due. If the return is filed late after a jeopardy assessment has been issued, pursuant to KRS , the. How many years can I go back and file for a refund? You have 3 years from the You do not need to file a Mississippi Individual Income Tax return if you. You can file up to 3 years from the original deadline date. You can e-file up years late. After that, you must mail in paper returns. You may be able to. How long can the IRS collect back taxes? · What other options are there? · Frequently Asked Questions · What To Do Next · We know how the IRS works! If you filed with FreeTaxUSA, you can access and print your returns for the past seven years. Print Prior Year Returns. Request Copy From IRS. If you aren't a.

At Jackson Hewitt, you can get your back taxes done. The IRS allows electronic filing for the prior two years' tax returns and the current year. This means you. When to File Your Return If you file your return on a calendar year basis, the A copy of the tax return you filed in another state or country if you. Generally, a person or business has four years from the date on which the tax was due and payable to make a refund claim. However, the statute of limitations . Through this agreement, taxpayers can file their Federal and Missouri state income tax returns using approved software. You can electronically file 24 hours a. Generally, under IRC § , the IRS can collect back taxes for 10 years from the date of assessment. The IRS cannot chase you forever and, due to the IRS. Back To Income Tax Home. Alabama Direct E-filing Option. You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no. Depending on the circumstances, the Department may grant extensions for filing an excise tax return. If your return or payment is late and you feel you have a. How far Back Can You Amend a Tax Return? The time limit to file an amended tax return with the IRS is three years after filing the original tax return or two. Through this agreement, taxpayers can file their Federal and Missouri state income tax returns using approved software. You can electronically file 24 hours a. If you previously had an account with Online Services\I-File (prior to September 5, ), your username is no longer valid, and you will need to create a. The simple answer is six years. According to tax law, if you have six years or less of unfiled taxes, you must file them to get back into good standing with. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax return's due date or deadline. For example, you. How Many Years of Back Taxes Do I Need to File? The number of years you need to file depends on how long it's been since you filed a tax return. For. You can file both your Maryland and federal tax returns online using approved software on your personal computer. Last year over million individual income tax returns were filed. Of these, over 92% were filed electronically! eFiling is fast, safe, and easy! If you do. How far Back Can You Amend a Tax Return? The time limit to file an amended tax return with the IRS is three years after filing the original tax return or two. Back To Income Tax Home. Alabama Direct E-filing Option. You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no. Simply filing the return late can result in a “failure to file” penalty. If you owe tax on those returns, but did not pay prior to April 15 of the following. For tax years through , you can file your original Form IL through your MyTax Illinois account. Footer. Back to top. About IDOR. Contact Us. Is it too late to file past year taxes? It is not too late to file back taxes. You can use FreeTaxUSA to file taxes from all the way back to Use.

What Does Flight Ticket Insurance Cover

Allianz offers flight insurance plans for those traveling domestically or internationally. Affordable plans as low as $ Trip Cancellation is a pre-departure benefit that provides reimbursement for prepaid and non-refundable travel expenses if a trip is canceled due to unforeseen. Trip insurance benefits Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more. Cover your trip with travel protection · Trip Cancellation · Trip Interruption · Travel Delay · Baggage Loss and Delay · Emergency medical and dental expenses. It covers against lost, stolen or damaged baggage as well as providing benefits for travel inconvenience you may experience. View the conditions of the Travel. What does Flight Insurance's Travel Assistance include? · Medical consultation and monitoring · Prescription assistance · Emergency medical payments · hour legal. This can provide financial protection in cases of covered trip cancellations, unexpected medical expenses while traveling and costs incurred due to baggage. Comprehensive travel insurance typically covers canceled flights that delay your trip for at least 3–12 hours. If your flight is delayed more than 12 hours. Trip Cancellation Insurance will reimburse you for the amount of pre-paid, non-refundable travel expenses (eg airline, cruise, train, hotel, etc.) that you. Allianz offers flight insurance plans for those traveling domestically or internationally. Affordable plans as low as $ Trip Cancellation is a pre-departure benefit that provides reimbursement for prepaid and non-refundable travel expenses if a trip is canceled due to unforeseen. Trip insurance benefits Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more. Cover your trip with travel protection · Trip Cancellation · Trip Interruption · Travel Delay · Baggage Loss and Delay · Emergency medical and dental expenses. It covers against lost, stolen or damaged baggage as well as providing benefits for travel inconvenience you may experience. View the conditions of the Travel. What does Flight Insurance's Travel Assistance include? · Medical consultation and monitoring · Prescription assistance · Emergency medical payments · hour legal. This can provide financial protection in cases of covered trip cancellations, unexpected medical expenses while traveling and costs incurred due to baggage. Comprehensive travel insurance typically covers canceled flights that delay your trip for at least 3–12 hours. If your flight is delayed more than 12 hours. Trip Cancellation Insurance will reimburse you for the amount of pre-paid, non-refundable travel expenses (eg airline, cruise, train, hotel, etc.) that you.

Travel insurance can reimburse you for your prepaid trip costs plus the extra cost of flying back home early. If your trip is delayed because the storm canceled. Arranges and pays for medically necessary transportation following a covered injury or illness to an appropriate medical facility to receive care and get you. What does this flight insurance cover? Flight departure delays, missed connections, and tarmac delays – and many of these claims can be filed and processed. Travel health insurance does not provide a Trip Cancellation benefit, so there is no coverage for a canceled trip. It may be a good option for you if you are. What does flight insurance cover? · Death of Immediate Family · Flight Cancellation · Medical Condition · Illness/Injury. The insurance menu includes five main courses: trip cancellation and interruption, medical, evacuation, baggage, and flight insurance. Supplemental policies can. Travel insurance administered by Allianz Global Assistance can help by covering cancellation, trip interruption, baggage, travel accidents and COVID If you have to cancel or modify your trip for a reason covered by your contract, Allianz Travel insurance reimburses the amount of your ticket that you have to. A comprehensive travel insurance policy should offer protection for your flight should you need to cancel or amend your plans for reasons beyond your control. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and. Coverage is available for things like medical bills for emergencies, changing flights if you're too sick to travel, having someone fly out to be. Trip Interruption Insurance – After Departure covers the costs you would incur if you have to return home earlier or later than you originally planned. It. Ans: Any airline insurance that you have taken on your airline ticket will provide varying flight insurance coverage. Some of the most common airline insurance. The main categories of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, rental property and rental. With flight cancellation insurance, you're eligible for compensation for any losses incurred due to cancelled flights. Just be sure to read through the. A Travel Guard travel insurance plan can help cover your trip investment and offset expenses from travel mishaps when you travel. Trip Cancellation is one of the main reasons to purchase travel protection. When it comes to air travel, if an airline cancels your flight because of inclement. Arranges and pays for medically necessary transportation following a covered injury or illness to an appropriate medical facility to receive care and get you. The comprehensive policy usually covers delays, cancellation due to sickness or death, lost luggage and some emergency medical costs. Just read the fine print. Trip Cancellation Coverage reimburses you for pre-paid, non-refundable expenses if you need to cancel your trip before you depart. Covered reasons to cancel.

Who Pays The Carbon Tax

The Federal Carbon Tax appears as a separate charge on your power bill. The tax applies to how much power you use, and not to fixed amounts like the basic. The total annual fuel charge cost for a residential natural gas user is estimated to be $ Future federal carbon tax increases. This PDF projects the. A carbon tax is imposed on industries that emit carbon dioxide through their operations. About 35 nations currently tax businesses that produce greenhouse. Carbon Tax gives effect to the polluter-pays-principle and helps to ensure that firms and consumers take the negative adverse costs (externalities) of. Carbon charges and your SaskEnergy billAs part of the federal government's carbon pricing system, a Federal Carbon Tax applies to all fossil fuels. Canada's carbon-tax history began in March , when Alberta became North America's first jurisdiction to legislate greenhouse gas reductions. Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for. Carbon pricing is a policy tool to lower emissions of carbon dioxide and other greenhouse gases, by putting a tax or other price on them. Carbon Pricing effectively shifts the responsibility of paying for the damages of climate change from the public to the GHG emission producers. This gives. The Federal Carbon Tax appears as a separate charge on your power bill. The tax applies to how much power you use, and not to fixed amounts like the basic. The total annual fuel charge cost for a residential natural gas user is estimated to be $ Future federal carbon tax increases. This PDF projects the. A carbon tax is imposed on industries that emit carbon dioxide through their operations. About 35 nations currently tax businesses that produce greenhouse. Carbon Tax gives effect to the polluter-pays-principle and helps to ensure that firms and consumers take the negative adverse costs (externalities) of. Carbon charges and your SaskEnergy billAs part of the federal government's carbon pricing system, a Federal Carbon Tax applies to all fossil fuels. Canada's carbon-tax history began in March , when Alberta became North America's first jurisdiction to legislate greenhouse gas reductions. Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for. Carbon pricing is a policy tool to lower emissions of carbon dioxide and other greenhouse gases, by putting a tax or other price on them. Carbon Pricing effectively shifts the responsibility of paying for the damages of climate change from the public to the GHG emission producers. This gives.

A carbon price, often incorrectly referred to as a carbon tax, is a charge placed on greenhouse gas pollution mainly from burning fossil fuels. The CCR is a quarterly tax-free payment to help eligible individuals and families, with most receiving more than they pay into the federal pollution pricing. Metcalf is an internationally recognized expert on energy and environmental taxation and has written extensively on climate policy and carbon pricing. The solution to such externalities is simple: put a tax on carbon emissions, so that the price people pay to emit carbon equals the damage it. A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden social costs of. A carbon tax is not guaranteed to achieve a specific quantity of GHG emissions. Entities covered by the tax pay a fixed price for each ton of GHGs emitted. By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will. The intent of carbon pricing is to signal the market to invest in greenhouse gas emission reducing activities to avoid paying the price. In designing a carbon. The other key feature of policy is its requirement for “revenue neutrality”. The government must—by law—offset carbon tax revenues through matching cuts to. All Albertans will pay the tax no matter who their provider is. Learn more about this Federal Carbon Tax. In other words, domestic industries pay both carbon prices. For example, if the EU permit price were £8 per tonne, UK industries would pay a total carbon price. The total annual fuel charge cost for a residential natural gas user is estimated to be $ Future federal carbon tax increases. This PDF projects the. In , the Washington Legislature passed the Climate Commitment Act (CCA), which establishes a comprehensive, market-based program to reduce carbon pollution. If it emits more than its annual limit, it must pay for each extra ton of GHG. For this, a facility has 2 options: 1) pay the carbon price to the government, or. The federal carbon tax was introduced in to put a price on carbon pollution. Today, CFIB estimates that small businesses pay about 40% of the carbon tax. About two-thirds of Americans will receive more in Dividends than they will pay in higher prices. carbon pricing policies. Building upon existing tax and. Carbon pricing is a policy tool to lower emissions of carbon dioxide and other greenhouse gases, by putting a tax or other price on them. The intent of carbon pricing is to signal the market to invest in greenhouse gas emission reducing activities to avoid paying the price. In designing a carbon. carbon price. Background. Who pays the tax: carbon pricing by sector and country under alternative climate scenarios. II. Page 4. Figure ES Distribution of. The tax or fee is charged for every one tonne of greenhouse gases (GHGs) that is emitted into the atmosphere. The concept of putting a tax on carbon emissions.

How Much To Rent A Lambo For A Day

Lamborghini Rental in New York, NY. $/day. lAMBORGHINI AVENTADOr Veluxitys New York Lamborghini Rentals have gone far and beyond to ensure. Looking for Lamborghini Luxury Car Hire UK? Starr Luxury Cars has the largest fleet of Lamborghini Luxury Car Hire UK in the UK. PRICE MATCH GUARANTEE. The typical cost to rent a Lamborghini Huracan Spyder starts from $1, – $ per day with a security deposit of $ – $ They average allowable. How much is it to rent a Lamborghini Urus? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. For. Finally, Lamborghini Urus rentals offer flexibility. You can rent a Lamborghini Urus for a day, a week, or even a month, depending on your needs. Plus, with. Lamborghini models available for rent in Zagreb, Croatia. Check details Price per day. € Service Ratings (31) · Lamborghini Huracan EVO Spyder. Lamborghini Urus for $45/day. What y'all think about it? Worth it? You can rent a Lamborghini Huracan from Dream Charters for $ per day during the week, $ per day during the weekend, and $ for a 3 day weekend. how. How much is it to rent a Lamborghini Huracan? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. Lamborghini Rental in New York, NY. $/day. lAMBORGHINI AVENTADOr Veluxitys New York Lamborghini Rentals have gone far and beyond to ensure. Looking for Lamborghini Luxury Car Hire UK? Starr Luxury Cars has the largest fleet of Lamborghini Luxury Car Hire UK in the UK. PRICE MATCH GUARANTEE. The typical cost to rent a Lamborghini Huracan Spyder starts from $1, – $ per day with a security deposit of $ – $ They average allowable. How much is it to rent a Lamborghini Urus? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. For. Finally, Lamborghini Urus rentals offer flexibility. You can rent a Lamborghini Urus for a day, a week, or even a month, depending on your needs. Plus, with. Lamborghini models available for rent in Zagreb, Croatia. Check details Price per day. € Service Ratings (31) · Lamborghini Huracan EVO Spyder. Lamborghini Urus for $45/day. What y'all think about it? Worth it? You can rent a Lamborghini Huracan from Dream Charters for $ per day during the week, $ per day during the weekend, and $ for a 3 day weekend. how. How much is it to rent a Lamborghini Huracan? The cost of your rental depends on the rental length, location, optional insurance products and add-ons.

We get miles and get it all day. What should I have planned during the day?you can't drive that far what are you supposed to do that whole. supercar or sports car to partake in our experiences. A little money goes a long way towards getting you behind the seat of your dream car for a day or a. Yes, you can certainly rent a Lamborghini Urus for just a day! Our exotic Lamborghini Urus car for hire is never far from reach. What's required to. $/day · Lamborghini Huracan EVO — Car rental alternative in Miami Many Turo hosts offer discounted prices for weekly and monthly trips, as. Renting a Lamborghini typically costs between $ to $ per hour, depending on the model and rental company. Some luxury rental services may. So better take your chance and rent your perfect Lamborghini in Germany for a day far more than just a simple Lamborghini rental company in Germany. How much is it to rent a Lamborghini Urus? The cost of your rental depends on the rental length, location, optional insurance products and add-ons. For. Lamborghini Aventador SV rental Miami profile view mph club-rszd. $2,/day Now with that much information, you can call to rent a Lamborghini from mph club. Dream Exotics offers Lamborghini rentals in Las Vegas at the lowest prices. If you want to spend a day in the seat of prestige and power, then make your. Experience the ultimate supercar with Lamborghini Rental starting from £ per day This could make owning a Lamborghini out of reach for many. But. But as far as cheap rental rates for Lamborghinis go, our $ starting rate per day is a good deal. After factoring in the hidden costs of ownership. Lamborghini RentalLos Angeles ; Huracan EVO Spyder AWD · $ /day ; Huracan EVO Spyder · $ /day ; Urus Performante · $ /day. The rental price ranges from $1, to $1, Per Day depending on the model you've chosen. Each of our clients can find a common language with Lamborghini for. Rent Lamborghini Huracan EVO in Turkey from EUR/day. Delivery of Lamborghini rent your Lamborghini Huracan EVO for the best price. 24/7 service. Hire our stunning Lamborghini Huracan Spyder from just £ per day (based on a week hire). The cost of a Lamborghini rental depends on where you pick it up and how you plan to use it. Prices start at $1, per day for the Urus and $1, per day for. Huracan Spyder hire. BESTSELLER Lamborghini Huracan Spyder hire. Prices from: £ per day. Self drive hire: Yes. Chauffeur Hire: Yes. Exterior: White. Interior. Mascot, New South Wales. 1 Day, $2,/DAY. Days, $2,/DAY. Days. $2,/DAY. 7+ Days, $1,/DAY. Chauffeur. $/HOUR. Supercar Hire Australia Wide! The typical cost to rent a Lamborghini Aventador S is $2, per day with a security deposit of $ – $ The average allowable mileage is miles/day. The average rental price is about dirhams per day. Lamborghini Aventador Coupe. This premium all-wheel-drive mid-engined supercar combines an elegant.

What Is Excise Tax Definition

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excise tax definition. Excise tax is a flat-rate tax levied on the sale of specific goods, services, and activities. It's a form of indirect taxation. An excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on soda. gasoline, and sports betting. EXCISE TAX meaning: → excise duty. Learn more. Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers. Excise tax refers to a tax on the sale of an individual unit of a good or service. The vast majority of tax revenue in the United States is generated from. Both sales and excise taxes violate the basic tax fairness principle of taxing according to one's ability to pay: low-income families are actually made to. Excise taxes are narrowly based taxes on consumption, levied on specific goods, services, and activities. They can be either a per unit tax (such as the per. An excise, or excise tax, is any duty on manufactured goods that is levied at the moment of manufacture rather than at sale. An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excise tax definition. Excise tax is a flat-rate tax levied on the sale of specific goods, services, and activities. It's a form of indirect taxation. An excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on soda. gasoline, and sports betting. EXCISE TAX meaning: → excise duty. Learn more. Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers. Excise tax refers to a tax on the sale of an individual unit of a good or service. The vast majority of tax revenue in the United States is generated from. Both sales and excise taxes violate the basic tax fairness principle of taxing according to one's ability to pay: low-income families are actually made to. Excise taxes are narrowly based taxes on consumption, levied on specific goods, services, and activities. They can be either a per unit tax (such as the per. An excise, or excise tax, is any duty on manufactured goods that is levied at the moment of manufacture rather than at sale.

Second, the definition of “luxury” changes over time. For example, a federal excise tax on telephone calls was first introduced in as a luxury tax to. Real estate excise tax (REET) is a tax on the sale of real property. All sales of real property in the state are subject to REET unless a specific exemption is. Detailed Explanation: Excise taxes are usually paid by the producer and “passed through” to the consumer in the form of a higher price. They are “hidden” from. (1) For purposes of this part, the manufacturers excise tax generally attaches when the title to the article sold passes from the manufacturer to a purchaser. Excise tax is an indirect tax on specific goods, services and activities. Federal excise tax is usually imposed on the sale of things like fuel, airline tickets. An excise tax is an indirect tax charged by the government on the sale of a particular good or service. An excise tax is a tax on the transfer of ownership from the seller to the buyer paid at closing. The tax amount is based on the sale price of the home. An excise tax is a fee the government charges on goods at the time they're manufactured, rather than when they're sold to consumers. Excise Tax is a type of tax that is imposed on specific items that belong to a particular class of goods. These classes of goods are often luxury or. Excise Tax. A transaction tax imposed by federal, state, and/or local governments, typically determined by multiplying a percentage by the value. Excise tax is a tax on a specific item, belonging to a special class of items. The classes of items are frequently specialty or luxury items, such as tobacco. Excise taxes are levied to discourage the consumption of certain types of products. The tax is paid by business but the cost is passed to consumers. Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state, and local governments and are not. There are many forms of taxation in the United States, some collected by the federal government and others by local governments and States. One tax in. Excise tax is a tax levied on goods manufactured in this country. From Project Gutenberg The money paid for license to sell spirituous liquors is an excise tax. Excise taxes are levied on items that can be viewed as harmful to health, such as alcohol and tobacco. Excise tax is an indirect tax charged to a producer of a good such as oil or tobacco that is ultimately passed onto a consumer via a higher price. excise tax in British English (ˈɛksaɪz tæks IPA Pronunciation Guide) noun a tax on goods, such as spirits, produced for the home market. An excise tax can be an extra percentage added on to certain goods or services. Excise tax can also be an extra fee or penalty on certain actions. Excise tax is a tax placed on the manufacture, sale, or use of certain goods and services. It can be imposed by both federal and state governments.