iphone4-apple.ru

Tools

20 000 Loan Over 10 Years

The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. Calculate your next loan! Information and interactive calculators are made available to you as self-help tools for your independent use. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. I get years for $k at 10% as costing $ in total interest! Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. A wide range of financial institutions offer personal loans, from banks and credit unions to personal finance companies and fintech lenders. While available. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. Personal loans can be your ticket to paying off high-interest credit card debt or tackling big bills. But like all debt, personal loans are not to be taken. This calculates the monthly payment of a $20k mortgage based on the amount of the loan, interest rate, and the loan length. It assumes a fixed rate mortgage. The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. Calculate your next loan! Information and interactive calculators are made available to you as self-help tools for your independent use. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. I get years for $k at 10% as costing $ in total interest! Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. A wide range of financial institutions offer personal loans, from banks and credit unions to personal finance companies and fintech lenders. While available. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. Personal loans can be your ticket to paying off high-interest credit card debt or tackling big bills. But like all debt, personal loans are not to be taken. This calculates the monthly payment of a $20k mortgage based on the amount of the loan, interest rate, and the loan length. It assumes a fixed rate mortgage.

Home improvement loans are available over an extended term, up to 10 years. You can choose to repay your loan over 2 to 8 years. If you want a home. 25 years in all other cases. If your down payment is more than 20% of your home's price, your lender sets your maximum amortization period. If you're interested in a loan between £20, and Home improvement loans of £7, or more are available over an extended term of up to 10 years. Representative APR applies to loans of £7, – £15, over 2–5 years. It usually takes less than 10 minutes to apply, but if you're not registered it. Try our Line of Credit & Loan Payment calculator now to estimate your minimum line of credit payments or installment payments on a personal loan. Be aware that the longer the term of the loan, the more interest you will pay. A £20, loan over 10 years will have lower monthly repayments than a £20, loan deal. Loan Repayment Example. Let's work through the example of a loan of £20, taken out over 5 years (60 months) with an annual APR of %. We'll. 4 years, 5 years, 6 years, 7 years, 8 years, 9 years, 10 years. Payment frequency You'll pay $ in interest after years. Term interest is the total interest. With these loans, you receive a lump sum and pay it off with a fixed interest rate for five to twenty years. Home Equity Line of Credit (HELOC). Unlike a home. 30 Year fixed rate amortization loan table: at 8 percent interest. ; 10, $19,, , , ; 11, $19,, , , Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. For instance, let's say you want to calculate your monthly payment on a $50, personal loan over seven years with a 12% rate. You can input those numbers. 30 Year fixed rate amortization loan table: at 8 percent interest. ; 10, $19,, , , ; 11, $19,, , , Your loan term also affects your monthly payment. This is the number of years to repay the loan. Most personal loans are installment loans with fixed interest. Loans from €5, - €75, and repay over terms from 1 to 10 years On a €20, loan over 5 years, at a fixed rate of % (% APR) you will. years) over which the loan will be repaid. 6 months, 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years, 10 years 20 years, Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. 10 years, 11 years, 12 years, 13 years, 14 years, 15 years, 16 years, 17 years, 18 years, 19 years, 20 years The number of years over which you will repay. New mortgage length: 21 years,, 10 months. Create personalized report 20 years. -1 month faster. 3 years, 2 months faster. 1 month faster. Interest. The personal loan calculator displays three numbers: total interest, total paid, and monthly payment. You can use them to evaluate and compare personal loans.

Pella Doors Vs Andersen Doors

Get a comparison of working at Pella Windows and Doors vs Andersen Corporation. Compare ratings, reviews, salaries and work-life balance to make the right. pella impervia · Composite vs. Fiberglass: Andersen Series & Pella Impervia · DunRite Compares The Two Most Popular High-End Windows · Home · Windows · Doors. Andersen has an A+ rating with the Better Business Bureau (BBB), while Pella has a D- rating. Despite Andersen's high rating, both have surprisingly poor. Explore three types of doors. No matter the type of door you need — front door, storm door or patio door — we have options that will meet your needs. Both manufacturers' window lines include wooden, clad and vinyl frames. However, while Andersen also has a composite construction line of frames, Jeld-Wen does. Pella Windows and Doors. @pellawindows. K subscribers• videos Pella Fiberglass and Vinyl vs. Andersen Fibrex. Pella Windows and Doors. 35K. When it comes to home windows, the two leading brands (Andersen and Pella) usually go head-to-head. There are various aspects to consider. Something else that may help you decide is customer satisfaction, and Andersen has around 90% fewer complaints than Pella, making it the clear winner in this. Bottom Line. Pella's windows tend to be at least 20 percent cheaper than Andersen windows. The top end of Pella's prices are roughly where Andersen's prices. Get a comparison of working at Pella Windows and Doors vs Andersen Corporation. Compare ratings, reviews, salaries and work-life balance to make the right. pella impervia · Composite vs. Fiberglass: Andersen Series & Pella Impervia · DunRite Compares The Two Most Popular High-End Windows · Home · Windows · Doors. Andersen has an A+ rating with the Better Business Bureau (BBB), while Pella has a D- rating. Despite Andersen's high rating, both have surprisingly poor. Explore three types of doors. No matter the type of door you need — front door, storm door or patio door — we have options that will meet your needs. Both manufacturers' window lines include wooden, clad and vinyl frames. However, while Andersen also has a composite construction line of frames, Jeld-Wen does. Pella Windows and Doors. @pellawindows. K subscribers• videos Pella Fiberglass and Vinyl vs. Andersen Fibrex. Pella Windows and Doors. 35K. When it comes to home windows, the two leading brands (Andersen and Pella) usually go head-to-head. There are various aspects to consider. Something else that may help you decide is customer satisfaction, and Andersen has around 90% fewer complaints than Pella, making it the clear winner in this. Bottom Line. Pella's windows tend to be at least 20 percent cheaper than Andersen windows. The top end of Pella's prices are roughly where Andersen's prices.

Pella makes a broader standard variety of window collection in distinct substances as compared to Andersen. You can view and purchase Andersen. Compare Pella's fiberglass to competitors including Andersen Fibrex, Marvin fiberglass and Milgard fiberglass. Andersen: In Pella and Andersen are both prominent window brands, with Pella pella vs andersen doors. De. iphone4-apple.ru I would opt for a more universal foot bolt or a Pella-specific one. This is I believe it's for Anderson doors only. I had to return it. It wasn't. Both Pella and Andersen offer stylish, durable, and high-quality products. Andersen has a broader selection of windows, from the Andersen series' simple. I know some folks swear by Pella, but to me, Andersen or Marvin seem to be a better product because their windows actually provide a sealed-space, which I. HomeCraft Windows vs Pella vs Andersen Windows & Doors · Pella Corporation is headquartered in Pella, Iowa and is a well-known manufacturer of windows and doors. Explore full Brands Comparison: Pella Windows Canada vs Andersen vs Jeld-Wen vs Vinyl-Pro Windows. Certifications, Warranty Options & more. If you need lower cost windows that don't sacrifice quality, you can go with Milgard and enjoy peace of mind with the lifetime warranty. The choice is yours. In terms of tensile strength, the fiberglass windows from Pella is the undisputed champion, showcasing an incredible 20x superiority in comparison to Andersen. Both Pella and Andersen offer energy-efficient windows that are made to provide a tight seal. Less air loss equals less cost, so it's a pretty sure bet that you. Modern vs. Traditional Appeal: Pella Impervia tends to lean towards a more contemporary look, whereas Andersen balances modern and traditional aesthetics. Discover why Pella is selected as the superior option over Andersen windows. Review the outstanding strength and durability of Pella fiberglass. Pella windows cost are equally expensive in terms of their high-end wood, clad windows, specifically the designer and architect series. Their fiberglass window. Andersen and Pella, Pella, and Andersen. The two window giants are compared more often than any other two brands, and for a good reason; each company offers. Compare company reviews, salaries and ratings to find out if Pella Windows and Doors or Renewal by Andersen is right for you. Pella Windows and Doors is. It's then fused together with glue which then creates the window or door frames. Andersen Fibrex material (Pella Fiberglass vs. Andersen Fibrex. Andersen crafts and designs windows and doors that are a true reflection of the self-expressive people who put them in their homes. Regarding tensile strength, our Pella fiberglass windows stands as the undisputed champion, demonstrating an incredible 20x superiority compared to Andersen. Andersen offers a broad array of window and door products to fit nearly any project need from new construction to replacement. Andersen products are sold at.

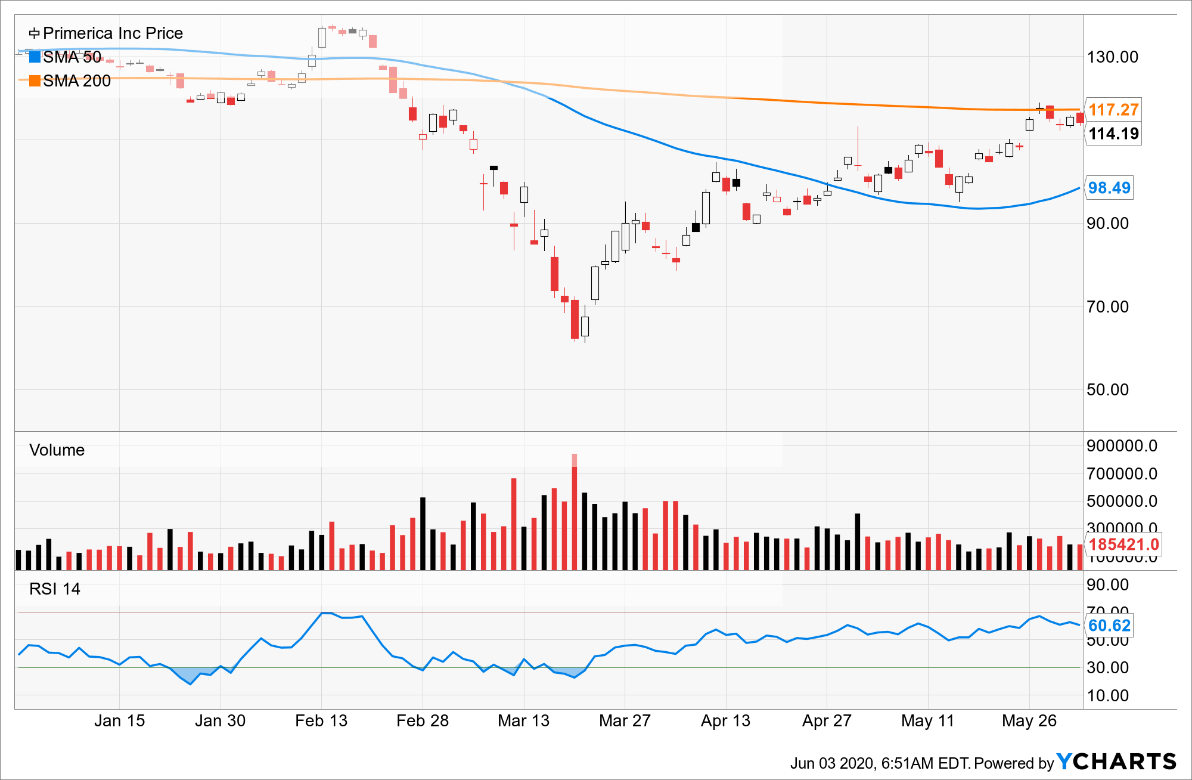

Primerica Stock Exchange

The current price of PRI is USD — it has decreased by −% in the past 24 hours. Watch Primerica, Inc. stock price performance more closely on the. Primerica, Inc. is currently in a favorable trading position (BUY) according to technical analysis indicators. More on Technical Analysis. Peers. Primerica stock is included in the S&P MidCap and the Russell stock indices and is traded on The New York Stock Exchange under the symbol “PRI”. Primerica Inc is a provider of financial services to middle-income households in the United States a Show More. Compare. Get the latest stock price for Primerica Inc. (PRI:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Primerica ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. Get Primerica Inc (PRI:NYSE) real-time stock quotes, news, price and financial information from CNBC. Get the latest Primerica, Inc. (PRI) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Discover real-time Primerica, Inc. Common Stock (PRI) stock prices, quotes, historical data, news, and Insights for informed trading and investment. The current price of PRI is USD — it has decreased by −% in the past 24 hours. Watch Primerica, Inc. stock price performance more closely on the. Primerica, Inc. is currently in a favorable trading position (BUY) according to technical analysis indicators. More on Technical Analysis. Peers. Primerica stock is included in the S&P MidCap and the Russell stock indices and is traded on The New York Stock Exchange under the symbol “PRI”. Primerica Inc is a provider of financial services to middle-income households in the United States a Show More. Compare. Get the latest stock price for Primerica Inc. (PRI:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Primerica ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. Get Primerica Inc (PRI:NYSE) real-time stock quotes, news, price and financial information from CNBC. Get the latest Primerica, Inc. (PRI) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Discover real-time Primerica, Inc. Common Stock (PRI) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Primerica is a financial services company with the goal of informing middle-income Americans and supplying them with the financial tools they need. Primerica offers mutual funds and variable annuities to help families build a secure financial future. PRIMERICA stock price in real-time. NYSE:PRI chart & historical data. Primerica Inc. is an American company active in finance. PRI Stock Performance ; Previous close, ; Day range, - ; Year range, - ; Market cap, 8,,, ; Primary exchange, NYSE. PRI | Complete Primerica Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Previous Close · Week High/Low · Volume · Average Volume · Price/Earnings (TTM) · Forward Annual Dividend & Yield · Market Capitalization, $M · 5-Day Change. Primerica, Inc. (iphone4-apple.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Primerica, Inc. | Nyse: PRI | Nyse. Primerica is a leading financial services provider that has been in business for over 40 years, is publicly traded on the New York Stock Exchange under the. Get Primerica Inc (PRI) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Primerica, Inc. engages in the provision of financial products to middle-income households. It operates through the following segments: Term Life Insurance. Price History. Primerica Inc. New York Stock Exchange: PRI. Discover historical prices for PRI stock on Yahoo Finance. View daily, weekly or monthly format back to when Primerica, Inc. stock was issued. Primerica Inc. ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. b ; Total Shares. m. Primerica Inc. · AT CLOSE PM EDT 09/04/24 · USD · % · Volume, Primerica Inc. ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, % ; Latest Dividend, $ ; Ex-Dividend Date, Aug 21, The all-time high Primerica stock closing price was on August 30, · The Primerica week high stock price is , which is % above the. Primerica Inc stock price live, this page displays NYSE PRI stock exchange data. View the PRI premarket stock price ahead of the market session. About Primerica Stock (NYSE:PRI) Primerica, Inc., together with its subsidiaries, provides financial products and services to middle-income households in the. Primerica, Inc. operates as a financial services firm. The Company offers products including term life insurance, mutual funds, variable annuities, mortgage. share was $ on BTT. Compared to the opening price on Friday 08/30/ on BTT of $, this is a gain of %. Primerica Inc.'s market capitalization.

Banks That Double Your Money

Rule of 72 ; If Annual Interest Rate from Your Investment= 10% p.a.. No. of Years to Double Your Money= 72/ = years ; If Annual Interest Rate from Your. Questions About Payments · How do I make a payment through my NSLSC account? · How do I set up automatic payments? · How can I update my banking information? · How. 8 High-Risk Investments That Could Double Your Money · 1. The Rule of 72 · 2. Investing in Options · 3. Initial Public Offerings · 4. Venture Capital · 5. Foreign. Very few investors know how long it takes to double their money. Rule of 72 can be of help. Divide 72 by the expected rate of return and the answer is the. With this rule, you can quickly calculate how long it takes your money to double. This reveals the positive effect that compound interest can have on your. The “Rule of 72” can help you estimate how long it could take to double your money if you continue to reinvest your earnings. Mobile Banking. 24/7. Information on how banks work, managing your accounts and teaching your kids about money double your money in a decade, ending up with $1, Of. There are better ways to double your money than get-rich-quick schemes. Learn about the magic of compound interest. You can buy money market funds from a bank Don't miss: CDs, high-yield savings accounts and treasury bills let you earn interest on your money, but which. Rule of 72 ; If Annual Interest Rate from Your Investment= 10% p.a.. No. of Years to Double Your Money= 72/ = years ; If Annual Interest Rate from Your. Questions About Payments · How do I make a payment through my NSLSC account? · How do I set up automatic payments? · How can I update my banking information? · How. 8 High-Risk Investments That Could Double Your Money · 1. The Rule of 72 · 2. Investing in Options · 3. Initial Public Offerings · 4. Venture Capital · 5. Foreign. Very few investors know how long it takes to double their money. Rule of 72 can be of help. Divide 72 by the expected rate of return and the answer is the. With this rule, you can quickly calculate how long it takes your money to double. This reveals the positive effect that compound interest can have on your. The “Rule of 72” can help you estimate how long it could take to double your money if you continue to reinvest your earnings. Mobile Banking. 24/7. Information on how banks work, managing your accounts and teaching your kids about money double your money in a decade, ending up with $1, Of. There are better ways to double your money than get-rich-quick schemes. Learn about the magic of compound interest. You can buy money market funds from a bank Don't miss: CDs, high-yield savings accounts and treasury bills let you earn interest on your money, but which.

Double Your Money Bank Account: Quick And Easy Method To Increase Your Savings [Paraskevopoulos, Andreas] on iphone4-apple.ru *FREE* shipping on qualifying. Put your money to work and get double your returns. With Doubble, you can set up an investment plan by yourself without the need for a 3rd. Switching your bank account to Barclays Divide 72 by your selected annual income rate to get the number of years it should take to double your money. Many brokerage firms, such as Fidelity, have relationships with different banks, allowing people to spread their money around without opening various accounts. It's hard to beat the Rule of 72 for its sheer simplicity. Here's the formula: Years to double your money = 72 ÷ assumed rate of return. Get ahead while doing some good. Saving is more than money in your account. Better savings habits improve your financial confidence and your overall sense of. earn to double your money within a set number of years. For example, if you Learn more about investment options from your bank's customer service. List of FD Double Deposit Schemes in India · SBI Fixed Deposit Double Scheme · ICICI Bank Double Your Money Scheme · Axis Bank Double Advantage Scheme · Bank of. EE Bonds. Guaranteed to double in value in 20 years View special instructions on how to cash in paper Savings Bonds that customers may bring in to your bank. Savings account balances have no risk of declining. Plus, FDIC insurance protects your money in the unlikely event that your bank or credit union goes under. Banking in the palm of your hand. Our Wells Fargo Mobile app gives you fast and secure access to your finances. It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by the interest rate you hope to. Doubling money through mutual funds will take approximately 5 to 6 years. Gold ETFs. Gold is an irresistible commodity in India. This yellow metal is an. There are options like Bank FD, Corporate FD, Mutual funds, Postal schemes to double the money. · If can invest for 7years or more then go for. With interest of 10% it will take just years to double your money. If that doesn't show why sticking your money in a bank savings account is. Now read carefully if you are below 23 and live in India, deposit rs 5,00,00 in you bank before you reach age The yearly interest you get. You can keep all your money in the bank sweep or diversify into 5 available Vanguard money market funds (each with a $3, minimum investment). Vanguard Bank. Stand a chance to double your money with FNB. Deposit K5, or more into your FNB personal account and maintain or grow that balance for Very few investors know how long it takes to double their money. Rule of 72 can be of help. Divide 72 by the expected rate of return and the answer is the. Unlike deposits at FDIC-insured banks and NCUA-insured credit unions, the money you invest in securities typically is not federally insured. You could lose your.

Options In Ira

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Not sure? Compare your options. · 1. Roll over to a John Hancock IRA. When you roll over to an IRA with John Hancock, you have choices. · 2. Roll over to another. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. With an IRA, you're able to save for retirement with tax advantages. IRAs allow you to choose among investment options like mutual funds, individual securities. Trade the futures markets while enjoying the tax benefits of an IRA. An IRA (Individual Retirement Account) is a trust or custodial account set up in the. With a GuideStone IRA, you have full access to our wide range of faith-based investment options, including both Traditional and Roth IRAs. Types of IRAs include traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs. Money. Which retirement accounts can accept rollovers? You can roll your money into almost any type of retirement plan or IRA. See the rollover chart PDF for options. To help you personally invest and manage your IRA money, Fidelity offers a wide range of options to choose from. Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Not sure? Compare your options. · 1. Roll over to a John Hancock IRA. When you roll over to an IRA with John Hancock, you have choices. · 2. Roll over to another. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. With an IRA, you're able to save for retirement with tax advantages. IRAs allow you to choose among investment options like mutual funds, individual securities. Trade the futures markets while enjoying the tax benefits of an IRA. An IRA (Individual Retirement Account) is a trust or custodial account set up in the. With a GuideStone IRA, you have full access to our wide range of faith-based investment options, including both Traditional and Roth IRAs. Types of IRAs include traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs. Money. Which retirement accounts can accept rollovers? You can roll your money into almost any type of retirement plan or IRA. See the rollover chart PDF for options. To help you personally invest and manage your IRA money, Fidelity offers a wide range of options to choose from.

An "Iron Condor" is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Trading. Whether you need a simple IRA, or something more personalized, we have the products and expertise to help you build a portfolio that fits you. The specific details and tax benefits of your IRA depend on if you choose a Traditional or Roth IRA. IRAs typically offer more investment options than Ks. Simplified investing with low fees. Portable IRA that belongs to you. CalSavers can help you on the path to retirement savings. Learn more about your options. At Navy Federal, you have options. You can open a Traditional, Roth or SEP IRA. We also offer retirement certificates, money market and jumbo money market. IRA Certificate · Low minimum opening deposit of $ · Term length choices of 3, 6, 9, 12, 18, 24, 30, 36, 48 or 60 months · Choice of a Traditional or Roth. Truliant IRAs. There are multiple IRA options available with a broad range of tax advantages. Primarily, most IRAs are one of two types: Roth and Traditional. Types of IRAs · A SIMPLE IRA plan is a Savings Incentive Match Plan for Employees set up by an employer. · A SARSEP - the Salary Reduction Simplified Employee. Contributing to an IL Secure Choice IRA through payroll deduction offers some tax benefits and consequences. However, not everyone is eligible to contribute to. With a Principal IRA, you'll choose from a range of investment options such as mutual funds, stocks, bonds, and exchange-traded funds. Beneficiaries of an IRA, and most plans, have the option of taking a IRA), the non-spouse beneficiary's options are: Take distributions based on. You can trade options in most IRAs provided they request the right settings. This includes Traditional, Rollover, Roth, Simple, and SEP IRAs. Buying Power Requirements for IRA Futures Trading · Long options on futures: Debit paid · Short options on futures: 2X SPAN Margin Requirement · Long/short options. If you are a more seasoned investor and would like to manage your own investments, then a Brokerage IRA may be for you. You'll be able to choose from a wide. A traditional IRA may be the better choice if you foresee being in a lower tax bracket, and subject to lower tax rates on your future withdrawals. At. Individual retirement accounts (IRAs) Save for your future your way. Owning a Vanguard IRA® means you get flexibility. We have a variety of accounts and. Compare IRA options · Money Market IRA · Featured CD IRA · Fixed Term CD IRA · Flexible CD IRA. IRA investments feature a wide selection of options. Compare Traditional, Roth IRA, and Rollover IRA accounts. Start saving with KeyBank today. Options still have their uses in a Roth IRA. They can, for example, provide a way for an investor to hedge against an expected market correction without selling. Start investing today. Enjoy $0 commissions on online US-listed stock, ETF, mutual fund, and options trades with no account minimums

Hdgcx

Find the latest performance data chart, historical data and news for The Hartford Dividend and Growth Fund Class C (HDGCX) at iphone4-apple.ru (HDGCX). HDGIX (Mutual Fund). THE HARTFORD DIVIDEND AND GROWTH FUND. Payout Change. Pending. Price as of: AUG 08, PM EDT. $ + +%. primary theme. The Hartford Dividend and Growth Fund HDGCX has $ BILLION invested in fossil fuels, 15% of the fund. Gain insights into The Hartford Dividend and Growth Fund Class C (HDGCX) financial statistics with a focus on efficiency ratios for informed ROI decisions. HDGCX. The Hartford Dividend and Growth Fund Class C. $ %. add_circle_outline. HDGRX. The Hartford Dividend and Growth Fund Class R3. $ %. Hartford Dividend and Growth Fund;C mutual fund holdings by MarketWatch. View HDGCX holdings data and information to see the mutual fund assets and. Symbol, HDGCX ; Manager & start date. Matthew Baker. 01 Mar Nataliya Kofman. 08 Aug Brian Schmeer. ; US stock, % ; Non-US stock, The Hartford Dividend and Growth Fund C (HDGCX) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record. See holdings data for Hartford Dividend and Growth Fund (HDGCX). Research information including asset allocation, sector weightings and top holdings for. Find the latest performance data chart, historical data and news for The Hartford Dividend and Growth Fund Class C (HDGCX) at iphone4-apple.ru (HDGCX). HDGIX (Mutual Fund). THE HARTFORD DIVIDEND AND GROWTH FUND. Payout Change. Pending. Price as of: AUG 08, PM EDT. $ + +%. primary theme. The Hartford Dividend and Growth Fund HDGCX has $ BILLION invested in fossil fuels, 15% of the fund. Gain insights into The Hartford Dividend and Growth Fund Class C (HDGCX) financial statistics with a focus on efficiency ratios for informed ROI decisions. HDGCX. The Hartford Dividend and Growth Fund Class C. $ %. add_circle_outline. HDGRX. The Hartford Dividend and Growth Fund Class R3. $ %. Hartford Dividend and Growth Fund;C mutual fund holdings by MarketWatch. View HDGCX holdings data and information to see the mutual fund assets and. Symbol, HDGCX ; Manager & start date. Matthew Baker. 01 Mar Nataliya Kofman. 08 Aug Brian Schmeer. ; US stock, % ; Non-US stock, The Hartford Dividend and Growth Fund C (HDGCX) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record. See holdings data for Hartford Dividend and Growth Fund (HDGCX). Research information including asset allocation, sector weightings and top holdings for.

Get the latest annual income statement and key ratios for THE HARTFORD DIVIDEND AND GROWTH FUND CLASS C (HDGCX) with StockTargetAdvisor. The Hartford Dividend And Growth Fund Class C: (MF: HDGCX). (NASDAQ Mutual Funds) As of Jul 18, PM ET. Add to portfolio. $ USD. ( 40 Followers, 10 Following, 1 Posts - hdgcx (@cagavad) on Instagram: "يبتعد شيء ليقترب شيء اجمل هاكذا هي الحياة ، Something moves away to approach. HDGCXIHGIXHDGFXHDGIXHDGSXHDGTX. %. prison industry. 13%. borders industry. %. high risk. F. Hartford Core Equity Fund. HGIRXHAIAXHGISXHGIIXHGIYXHGIFX. HDGCX Performance - Review the performance history of the Hartford Dividend and Growth C fund to see it's current status, yearly returns, and dividend. Find our live The Hartford Dividend And Growth Fund Class C fund basic information. View & analyze the HDGCX fund chart by total assets, risk rating. Tickers A: IHGIX C: HDGCX F: HDGFX I: HDGIX R3: HDGRX. R4: HDGSX R5: HDGTX R6: HDGVX Y: HDGYX. Inception Date 07/22/ Morningstar® Category Large Value. ETFs Holding THE HARTFORD DIVIDEND AND GROWTH FUND CLASS C (HDGCX). Exchange. All Exchanges. Symbol, Name, Exchange, HDGCX's Weight, Expense Ratio, Price(Change). Dividend history for stock HDGCX (The Hartford Dividend and Growt) including dividend growth rate predictions based on history. Info: Assuming annual dividend. View the latest Hartford Dividend and Growth Fund;C (HDGCX) stock price, news, historical charts, analyst ratings and financial information from WSJ. HDGCX at iphone4-apple.ru Current fund. HDGCX. The Hartford Dividend and Growth Fund. Family. Hartford Mutual Funds. Category. Large Value. Find another fund. The Hartford Dividend and Growth Fund. Shareclass. Hartford Dividend and Growth C (HDGCX). Type. Open-end mutual fund. Manager. Hartford Mutual Funds. The Hartford Dividend and Growth Fund C (HDGCX) dividend summary: yield, payout, growth, announce date, ex-dividend date, payout date and Seeking Alpha. A list of holdings for HDGCX (The Hartford Dividend and Growth Fund Class C) with details about each stock and its percentage weighting in the fund. HDGCX at iphone4-apple.ru Current fund. HDGCX. The Hartford Dividend and Growth Fund. Family. Hartford Mutual Funds. Category. Large Value. Find another fund. Complete history of HDGCX key financial ratios such as PE, liquidity, margins and others. HDGCX. HDGIX. HDGRX. HDGSX. HDGTX. HDGVX. HDGYX. HDGFX. Before you invest, you may want to review the Fund's prospectus, which contains more information about. The Hartford Dividend and Growth Fund HDGCX has a carbon footprint of 70 tonnes CO2 / $1M USD invested. Looking to find the intrinsic value of HDGCX? Select a valuation model from our list.

Get Money By Doing Surveys

There are two ways to take part and start earning cash · Online surveys. All you have to do is sign up, wait for survey alerts to land in your inbox, then zip. Online surveys — paid directly to your bank account · Create your free account. · Link your main bank accounts to earn double the pay per survey. · Complete Swagbucks lets you earn points (Swagbucks or SB) for taking surveys, which you can then redeem for gift cards or cash via PayPal. Pinecone. At Opinion Outpost, we have created a thriving community where anyone can sign up to our online survey platform and get rewards for their opinions. Our surveys take minutes. Product demos and interviews take Doing testing of this sort helps me keep building my marketing muscle. June. Tired of completing surveys for pennies? Complete 5 Surveys, Earn $5. It's that easy. Download our App. No minimum payout. Instant withdrawals. I used Swagbucks for bit. The individual surveys pay small but of course add up over time. The app has other things you can do for "Swagbucks". It's easy! You answer online surveys and short polls right from your computer or smartphone. InboxDollars then rewards you with your choice of free cash, PayPal. Have you ever thought about making some extra money by filling out surveys online? It sounds too good to be true, right? There are two ways to take part and start earning cash · Online surveys. All you have to do is sign up, wait for survey alerts to land in your inbox, then zip. Online surveys — paid directly to your bank account · Create your free account. · Link your main bank accounts to earn double the pay per survey. · Complete Swagbucks lets you earn points (Swagbucks or SB) for taking surveys, which you can then redeem for gift cards or cash via PayPal. Pinecone. At Opinion Outpost, we have created a thriving community where anyone can sign up to our online survey platform and get rewards for their opinions. Our surveys take minutes. Product demos and interviews take Doing testing of this sort helps me keep building my marketing muscle. June. Tired of completing surveys for pennies? Complete 5 Surveys, Earn $5. It's that easy. Download our App. No minimum payout. Instant withdrawals. I used Swagbucks for bit. The individual surveys pay small but of course add up over time. The app has other things you can do for "Swagbucks". It's easy! You answer online surveys and short polls right from your computer or smartphone. InboxDollars then rewards you with your choice of free cash, PayPal. Have you ever thought about making some extra money by filling out surveys online? It sounds too good to be true, right?

You just landed at the perfect app to make money. Introducing CashPiggy; The app that pays you real money, gift cards to do simple tasks like giving. You've earned those points by taking YouGov surveys! Choose your reward, we'll process it immediately. We add new rewards all the time, based on your feedback. In short, to make money from market research paid survey, you will need to do the following: 1. Join the right survey companies. 2. Understand how the survey. Being paid for completing online surveys is usually classified as income for tax purposes. It's considered to be similar to providing services under the sharing. Swagbucks, Survey Junkie, and Vindale Research allow users to earn points or cash through surveys and other activities. Pinecone Research is an. You can earn some extra money or other benefits simply by providing honest feedback. It is simple to earn money by taking surveys. The amount you are paid. Just curious if there are any real paid survey companies out there. Has anyone ever made any money taking online surveys? Where did you find. At Opinion Outpost, we have created a thriving community where anyone can sign up to our online survey platform and get rewards for their opinions. It's possible to earn money just by giving your opinion for market research. But how does it work and how much can you earn? Our guide explains everything. You can earn $1 per survey on average, which is significantly higher than many other survey sites. On top of that, there are no convoluted reward systems or. Swagbucks: Take Paid Surveys, Get Cash and Free Gift Cards*, Find Money Making Deals Swagbucks is a free reward app where you get paid for your opinion. Since , Poll Pay has paid millions in cash rewards to members for doing everyday online activities like taking paid surveys or playing games. The Poll Pay. Sign up for multiple platforms. To increase your earning potential with how to make money doing surveys, consider signing up for multiple survey platforms. Each. Swagbucks has paid out over $ million dollars to its members for taking online surveys and completing other related online activities. Take the necessary precautions when taking paid surveys online · Check for reviews · Make sure the privacy policy is clearly outlined · Make sure the site is not. American Consumer Opinion · Survey Junkie · Swagbucks · InboxDollars · Branded Surveys · Prime Opinion · Five Surveys · Prize Rebel · MySoapBox. Surveytime is global. You can take surveys for money from anywhere in the world. It doesn't matter where you are, if you successfully complete a survey, you. It's easy! You answer online surveys and short polls right from your computer or smartphone. InboxDollars then rewards you with your choice of free cash, PayPal. One of the most flexible options for making extra money online is MyLead. This platform allows users to earn money by filling out forms and promoting affiliate.

Best Dividend Stocks Buy Now

Dividend-paying stocks could potentially pump up total returns from your stock portfolio and generate extra income. Earnings: Companies that pay dividends tend to show. 3 reasons to consider dividend investing. Buffers. The Best Dividend Stock to Buy for Passive Income: CIBC or Pembina? August Stock Market News for Today. Wealth Building for Tomorrow. Founded in. US companies with the highest dividend yields ; IEP · D · %, USD ; MED · D · %, USD ; PETS · D · %, USD ; RILY · D · %, USD. Church & Dwight (CHD) is a consumable company you can't avoid. Another conservative stock, the company is paying out a tiny dividend that currently yields a. What are some good stocks to invest in right now with a high dividend yield and low price-to-earnings ratio? I like Lufax Holding (LU). It has. US companies with the highest dividend yields ; MNR · D · %, USD ; OFS · D · %, USD ; VOC · D · %, USD ; TPVG · D · %, USD. If the stock price doesn't rebound quickly, you may have a net loss. Finally, the strategy requires routinely buying and selling shares, which can lead to high. best businesses had to slash dividends during the pandemic in order to save cash. Does it matter when you buy a dividend stock? You need to own a stock. Dividend-paying stocks could potentially pump up total returns from your stock portfolio and generate extra income. Earnings: Companies that pay dividends tend to show. 3 reasons to consider dividend investing. Buffers. The Best Dividend Stock to Buy for Passive Income: CIBC or Pembina? August Stock Market News for Today. Wealth Building for Tomorrow. Founded in. US companies with the highest dividend yields ; IEP · D · %, USD ; MED · D · %, USD ; PETS · D · %, USD ; RILY · D · %, USD. Church & Dwight (CHD) is a consumable company you can't avoid. Another conservative stock, the company is paying out a tiny dividend that currently yields a. What are some good stocks to invest in right now with a high dividend yield and low price-to-earnings ratio? I like Lufax Holding (LU). It has. US companies with the highest dividend yields ; MNR · D · %, USD ; OFS · D · %, USD ; VOC · D · %, USD ; TPVG · D · %, USD. If the stock price doesn't rebound quickly, you may have a net loss. Finally, the strategy requires routinely buying and selling shares, which can lead to high. best businesses had to slash dividends during the pandemic in order to save cash. Does it matter when you buy a dividend stock? You need to own a stock.

Although it may seem complicated at first, all you need is a handful of stocks to make this strategy a reality. For example, Wal-Mart Stores Inc. (WMT) pays. Review your personal details and the billing plan before placing an order. Next, click on 'Invest now'. Lastly, choose between Monthly SIP or One Time. Top High Dividend Stocks ; Western Midstream Partners, LP (WES). Oil Refining & Marketing MLP. $ %. % ; MPLX LP (MPLX). Oil & Gas - Production. Verizon Hikes Dividend, Now Yields % As Stock Tops Buy Point With an annualized yield of %, Verizon is one of the highest dividend payers in the S&P Investors looking to boost their portfolios’ passive-income streams may find great high-yield bargains on some of the best dividend stocks in Canada today. High Dividend Stocks · BDCs - Arcc, Htgc, Gbdc, Tslx, · MLPs - EPD, ENB, MPLX, Et · REITs - O, Ohi, NNN, Frt, stwd, wpc, ritm · Tobacco - o, Bti. Arm & Hammer, OxiClean and Waterpik are just a few examples among dozens of its household brands. Church & Dwight was founded in and is today the leading. Description: Altria has a high dividend yield and is expanding into alternative products like e-cigarettes and cannabis. HP Inc. (HPQ): Sector. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy . 4 Undervalued Stocks That Just Raised Dividends · 3 Stocks to Buy With Reliable Dividends While They're Still Cheap · 3 Dividend Stocks for August · 10 Top-. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Best Dividend ETFs To Buy Now. ETFs Are you a set-it-and-forget-it income investor? These dividend ETFs provide a variety of long-term, cash-generating. High Dividend Stocks · BDCs - Arcc, Htgc, Gbdc, Tslx, · MLPs - EPD, ENB, MPLX, Et · REITs - O, Ohi, NNN, Frt, stwd, wpc, ritm · Tobacco - o, Bti. Scroll up, Click on “Buy Now with 1-Click”, and Grab a Copy Today! Read Best Dividend Stocks and Income Investments (Step by Step Investing). Joseph. Here's the Best Unknown High-Yield Dividend Stock to Buy Right Now With $1, · OTC Markets: A highly profitable subscription business · Paying regular and. Open Trading Account ; WPIL. Add to. Watchlist | Portfolio. ACTIONS. WPIL closes above Day Moving Average of today. · BPCL. Add to. Watchlist |. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. The top dividend-paying stocks for September include several transportation companies — Euronav NV (CMBT), BW LPG Ltd. (BWLP), TORM plc (TRMD), and Hafnia. In general following are the top dividend paying stocks: · and · However, not all of them are ripe for investing. · Good ones to go currently are. New Zealand companies below pay the highest dividends in the market: see them sorted by forward dividend yield and check out other stats too.

Adjustable Premium Term Life Insurance

Unlike whole life's guaranteed cash value, flexible premium adjustable life insurance has a fluctuating interest rate on the money contributed towards the. In its simplest form, life insurance is a promise between an insurance company and you, the policy owner. If you pay a certain amount of money (premium) to. Flexible premiums: With adjustable life insurance, you can lower your premium payments, and change the due date, or skip a payment altogether. This flexibility. term life to permanent life insurance, providing flexibility in coverage duration. ” Our policies are designed to be affordable, with adjustable premiums to. premiums than they would for a permanent life insurance policy. The Difference Between Term and Whole Life Insurance. Life can throw us many curveballs, and. Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise. An adjustable premium is an insurance premium that can change over time based on a policy that is agreed to at the outset of an insurance contract. IN THIS ARTICLE. Common types of level term; Renewable term policies; “Return of premium”. SHARE THIS. Adjustable life insurance is a hybrid policy between term life and whole life insurance The premium is the amount that the policyholders pay for the insurance. Unlike whole life's guaranteed cash value, flexible premium adjustable life insurance has a fluctuating interest rate on the money contributed towards the. In its simplest form, life insurance is a promise between an insurance company and you, the policy owner. If you pay a certain amount of money (premium) to. Flexible premiums: With adjustable life insurance, you can lower your premium payments, and change the due date, or skip a payment altogether. This flexibility. term life to permanent life insurance, providing flexibility in coverage duration. ” Our policies are designed to be affordable, with adjustable premiums to. premiums than they would for a permanent life insurance policy. The Difference Between Term and Whole Life Insurance. Life can throw us many curveballs, and. Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise. An adjustable premium is an insurance premium that can change over time based on a policy that is agreed to at the outset of an insurance contract. IN THIS ARTICLE. Common types of level term; Renewable term policies; “Return of premium”. SHARE THIS. Adjustable life insurance is a hybrid policy between term life and whole life insurance The premium is the amount that the policyholders pay for the insurance.

Annuities are long-term investment vehicles that Guardian® is a registered trademark of The Guardian Life Insurance Company of America, New York, NY. Flexibility: Unlike whole life or term life insurance, adjustable life insurance lets you change your death benefit and premiums as your needs and budget. Benefits. Guaranteed death benefit. Insurance coverage is guaranteed as long as premiums are paid. It's a great way to protect future insurability. Guaranteed. DreamSecure Flexible Life Insurance offers long-term, flexible coverage that can change as your life evolves. Learn more about adjustable policies from. The coverage can be "level" providing the same benefit until the policy expires or you can have "decreasing" coverage during the term period with the premiums. Variable universal life insurance is a type of permanent protection that offers flexibility and the potential for growth. variable. Universal life · Meet a long-term life insurance need · Allocate premiums to investment options you choose · Supplement retirement income · Leave a legacy. Adjustable Life Insurance Policy - his type of policy Scheduled Premium Variable Life has premium payments that are fixed for duration and amount. term life policies. Custom Choice. Variable Universal Life Insurance. Similar to traditional universal life insurance, but premium payments can be allocated. With term and permanent life insurance, you make premium payments so that in the event of your passing, your loved ones and beneficiaries will receive the death. Universal life insurance is also referred to as "flexible premium adjustable life insurance." It features a savings element (cash value) that grows on a tax-. insurers have created term life with a return of premium feature. The policy, you get the features of variable and universal life policies. You. A variable life insurance policy is a contract between you and an insurance company. It is intended to meet certain insurance needs, investment goals, and tax. How Does an Adjustable Life Policy Work? adjustable insurance policy. Adjustable life insurance combines the premium payment and death benefit features of term. Term life insurance coverage provides financial protection for your loved ones throughout your working years when your cost of insurance is typically less. term life to permanent life insurance, providing flexibility in coverage duration. Can I cash in a flexible premium adjustable life insurance policy? You can. IN THIS ARTICLE. Common types of level term; Renewable term policies; “Return of premium”. SHARE THIS. I want guaranteed cash value growth. Whole life insurance ; I want a guaranteed death benefit. Whole or term life ; I want guaranteed level premiums. Whole or. Level premiums. May be renewable or convertible. Some types of permanent insurance offer flexible premium payments and level or increasing death benefit options. But in general, permanent life insurance costs significantly more than term life insurance Variable UL: Premiums can vary within a certain range (with the.

Does Renters Insurance Cover Musical Instruments

Scheduled personal property coverage. This coverage helps protect specific, appraised valuables like engagement rings, antiques, musical instruments and coin. Whether you rent an apartment or a house, your landlord's insurance likely covers your building, but not your stuff. Now, as part of Union Plus, you can get. Many insurance providers offer the option to insure multiple musical instruments under a single renters or homeowners insurance policy, which can be more. 7. What is liability insurance? Renters insurance provides liability protection that covers you against lawsuits for bodily injury or property damage done by. Endorsements or add-ons can provide additional coverage for specific items, such as high-value jewelry, collectibles, or musical instruments. Tenants should. Liability protection: Typically, renter's insurance covers you against lawsuits for bodily injury or property damage done by you, your family members, and. It helps protect your musical instruments and accessories beyond what a homeowners or renters policy covers. Plus, there's no deductible. Typically, renters insurance provides four types of coverage: personal property coverage, renters liability insurance, guest medical expenses, and additional. Valuable Items Plus coverage from Travelers provides protection for special property such as jewelry, fine art, musical instruments and computers for an. Scheduled personal property coverage. This coverage helps protect specific, appraised valuables like engagement rings, antiques, musical instruments and coin. Whether you rent an apartment or a house, your landlord's insurance likely covers your building, but not your stuff. Now, as part of Union Plus, you can get. Many insurance providers offer the option to insure multiple musical instruments under a single renters or homeowners insurance policy, which can be more. 7. What is liability insurance? Renters insurance provides liability protection that covers you against lawsuits for bodily injury or property damage done by. Endorsements or add-ons can provide additional coverage for specific items, such as high-value jewelry, collectibles, or musical instruments. Tenants should. Liability protection: Typically, renter's insurance covers you against lawsuits for bodily injury or property damage done by you, your family members, and. It helps protect your musical instruments and accessories beyond what a homeowners or renters policy covers. Plus, there's no deductible. Typically, renters insurance provides four types of coverage: personal property coverage, renters liability insurance, guest medical expenses, and additional. Valuable Items Plus coverage from Travelers provides protection for special property such as jewelry, fine art, musical instruments and computers for an.

What's not covered by renters insurance? · Property damage to your buildings, roof, and siding (these are covered by your landlord) · Water damage caused by. Renters insurance covers your personal belongings and provides liability coverage similar to homeowners insurance. The property owner's insurance does not cover. It's also important to note that certain items, such as a musical instrument coverage to their homeowners or renters insurance policy to help cover certain. Basically all personal items, including but not limited to: computers, phones, clothing, books, musical instruments, art supplies, etc. are covered. The policy. Musical instruments can be insured under homeowners or renter's insurance, though it's important to find out coverage details. A renter's liability policy would cover the costs of your legal defense, up to the limits on your policy. Without this coverage, you could have to pay the costs. Renters insurance tends to cover loss or damage to items in the home related to fire, theft, vandalism, plumbing, and electrical malfunctions. Renters insurance. Renters insurance covers you and your personal property against things like theft, fires, vandalism, windstorms, and more—as well as. ❏ Clothing, Musical Instruments, Books and Supplies, Stereo Systems, Smartphones and Tablets. Does my renters insurance policy terminate once I graduate or. Clothing; Furniture; Your phone; Your TV, computer or other electronic equipment; Jewelry; Musical instruments; Sporting equipment. If you rent an apartment. Moreover, most homeowners/renters insurance policies do not cover business/professional use of said personal property, including musical instruments. Nationwide. Does renters insurance cover musical instruments? Renters insurance can cover musical instruments but will likely provide limited coverage. It is possible. Clothing; Furniture; A television or entertainment system; A computer; Musical or sporting equipment; Jewelry. Personal Property. With a renters policy, your. Safeguards possessions: Renters insurance can help cover losses when personal possessions are lost or damaged due to fire, lightning, windstorms, hail. Most renters insurance policies cap the coverage of certain high-value items like jewelry, antiques, musical instruments and rare collections. For example. Just as homeowners insurance covers musical instruments, so too does renters insurance. This works in much the same way as a homeowners policy, wherein coverage. equipment, musical instruments, etc. Personal property coverage can help Does renters insurance cover my belongings? A common misconception among. If you have expensive jewelry, furs, collectibles, sports equipment, or musical Like standard homeowners policies, most renters insurance policies do not. Musical Instrument Insurance · Homeowner Insurance · Condominium/Renters Insurance · Valuable Article Floaters · Earthquake, Windstorm coverage · Secondary Dwelling. Get to know your renters coverage options Renters insurance protects your personal belongings and also protects you if you're held legally responsible for.